Intro - What is PEAD?

Post-Earnings Announcement Drift (PEAD) anomaly is a phenomenon where the stock prices of firms continue to exhibit abnormal returns after they release their earnings reports. Specifically, the stock prices of firms that have reported positive earnings surprises tend to continue to rise in the days and weeks following the release of their earnings report, while the stock prices of firms that have reported negative earnings surprises tend to continue to decline.

To be clear, we will consider earnings surprise to be equal to:

\[ Avg\ Analyst\ Estimate\ of\ EPS - Actual\ Reported\ EPS \]

The PEAD anomaly is considered an anomaly because it contradicts the Efficient Market Hypothesis (EMH), which suggests that all available information is immediately reflected in stock prices, leaving no room for abnormal returns.

Several explanations have been proposed to explain the PEAD anomaly like the fact that investors may underestimate the persistence of a firm’s earnings surprises, leading to delayed price adjustments. Another explanation is that earnings surprises may contain information that is not captured in traditional accounting measures, leading to a delayed reaction by the market.

Regardless of the reason for its existence, the PEAD anomaly has important implications for investors and financial managers, as it suggests that trading strategies based on earnings surprises can generate abnormal returns. In addition, it also highlights the limitations of the EMH, which is a fundamental theory in finance.

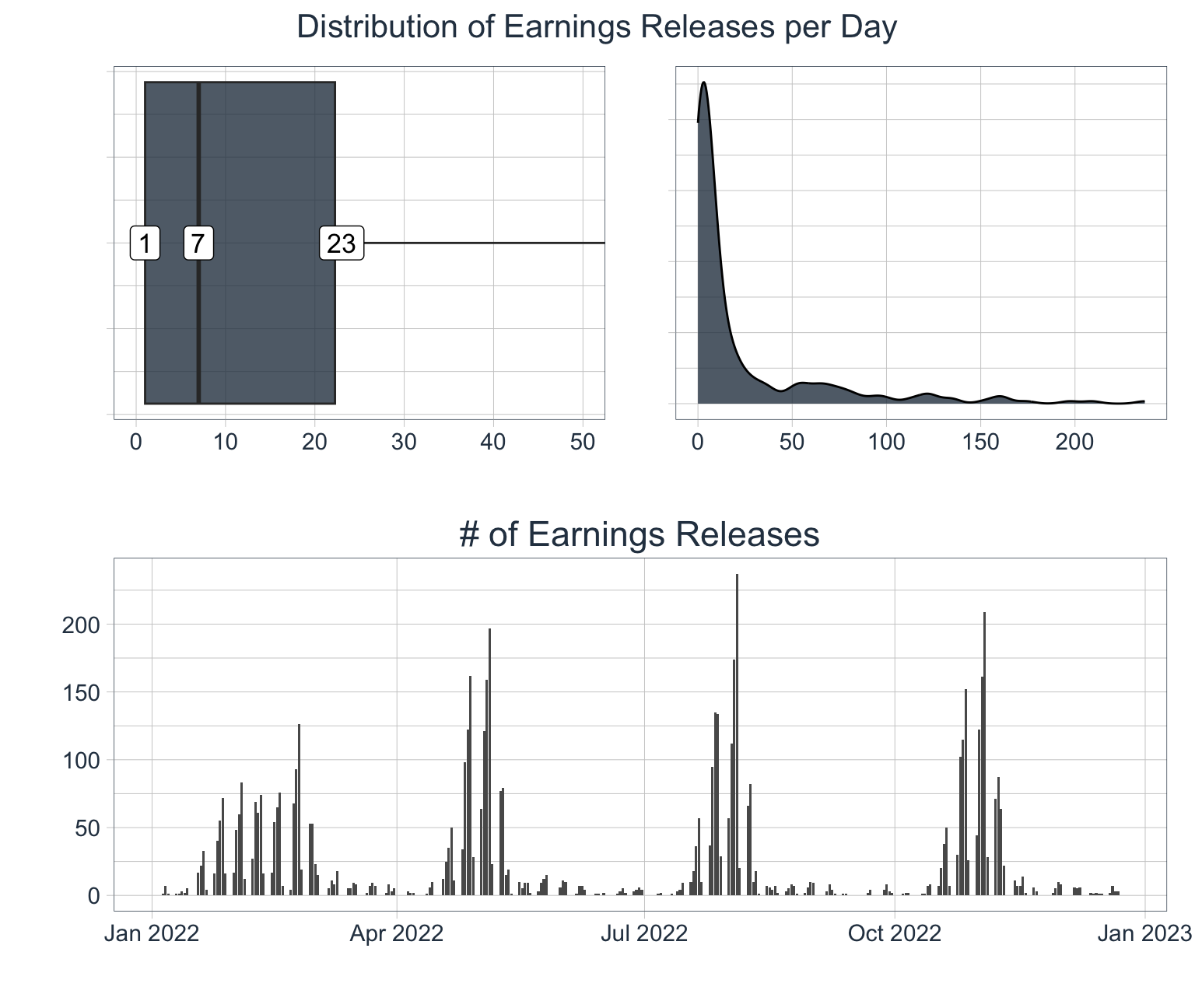

Let’s investigate the presence of PEAD and attempt to build a trading strategy with the use of Machine Learning. To do this I have gathered:

- Earnings History on 1,844 large, publicly-traded companies

- Price, Volume, and Miscellaneous Financial data for each of these companies

Illustrating the PEAD Anomaly

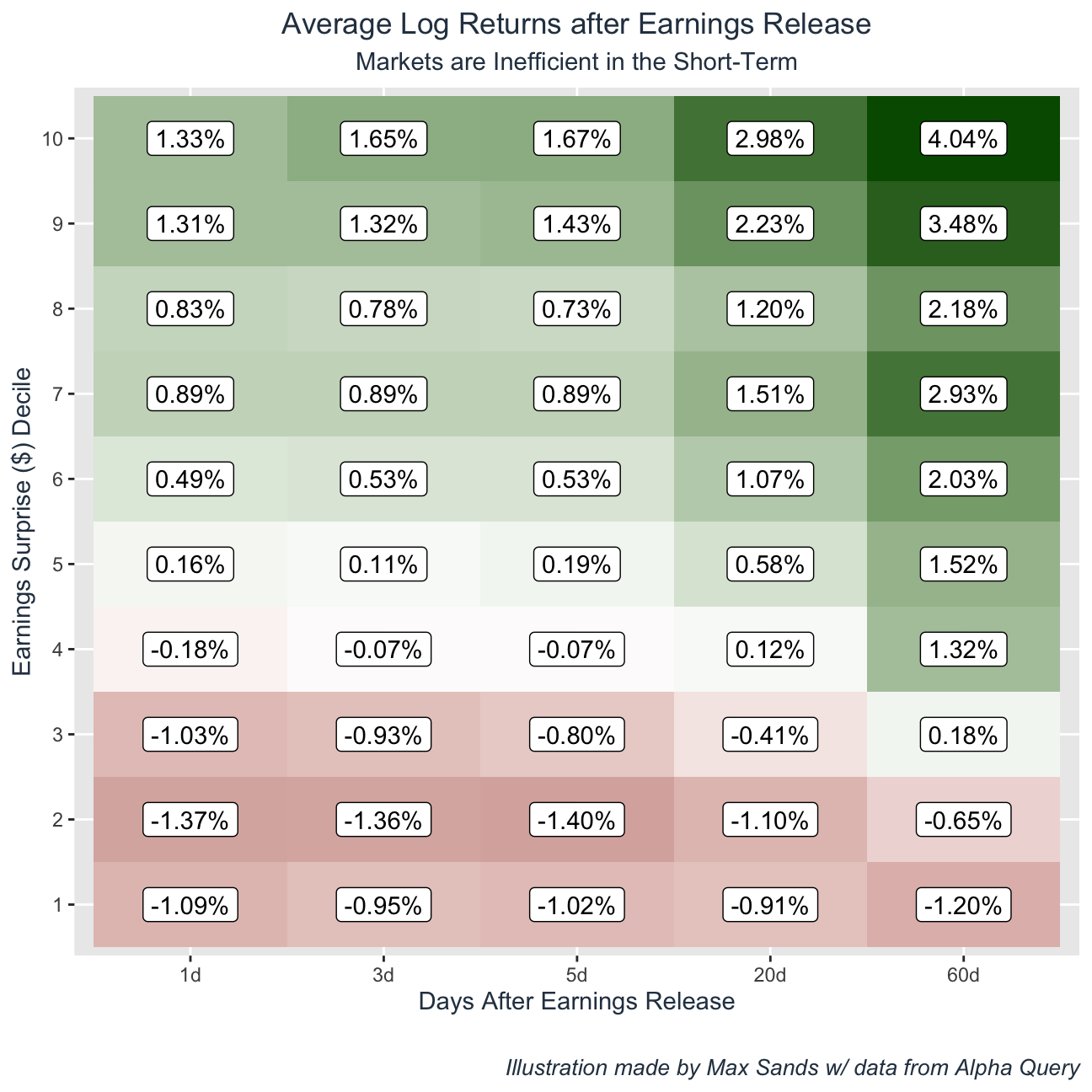

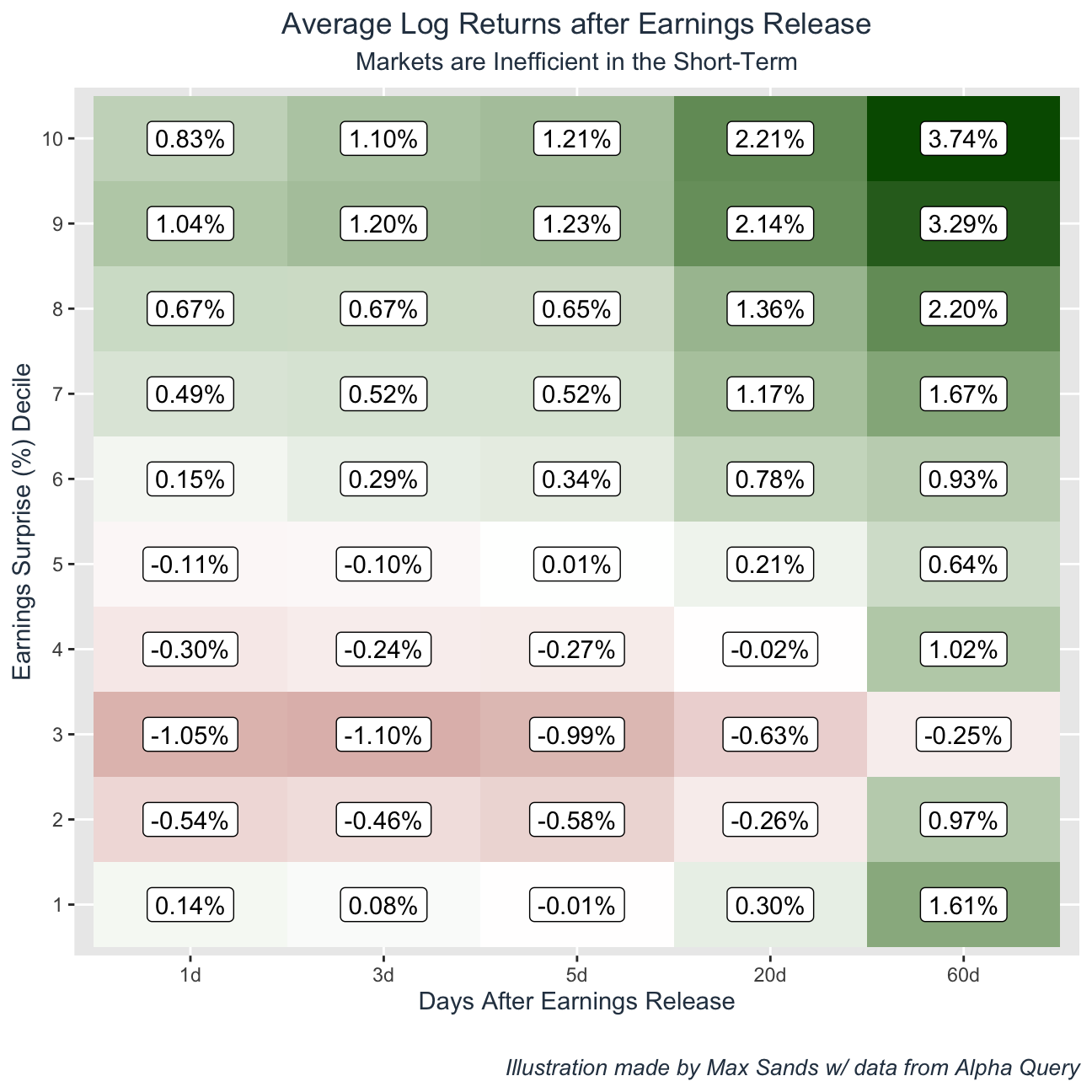

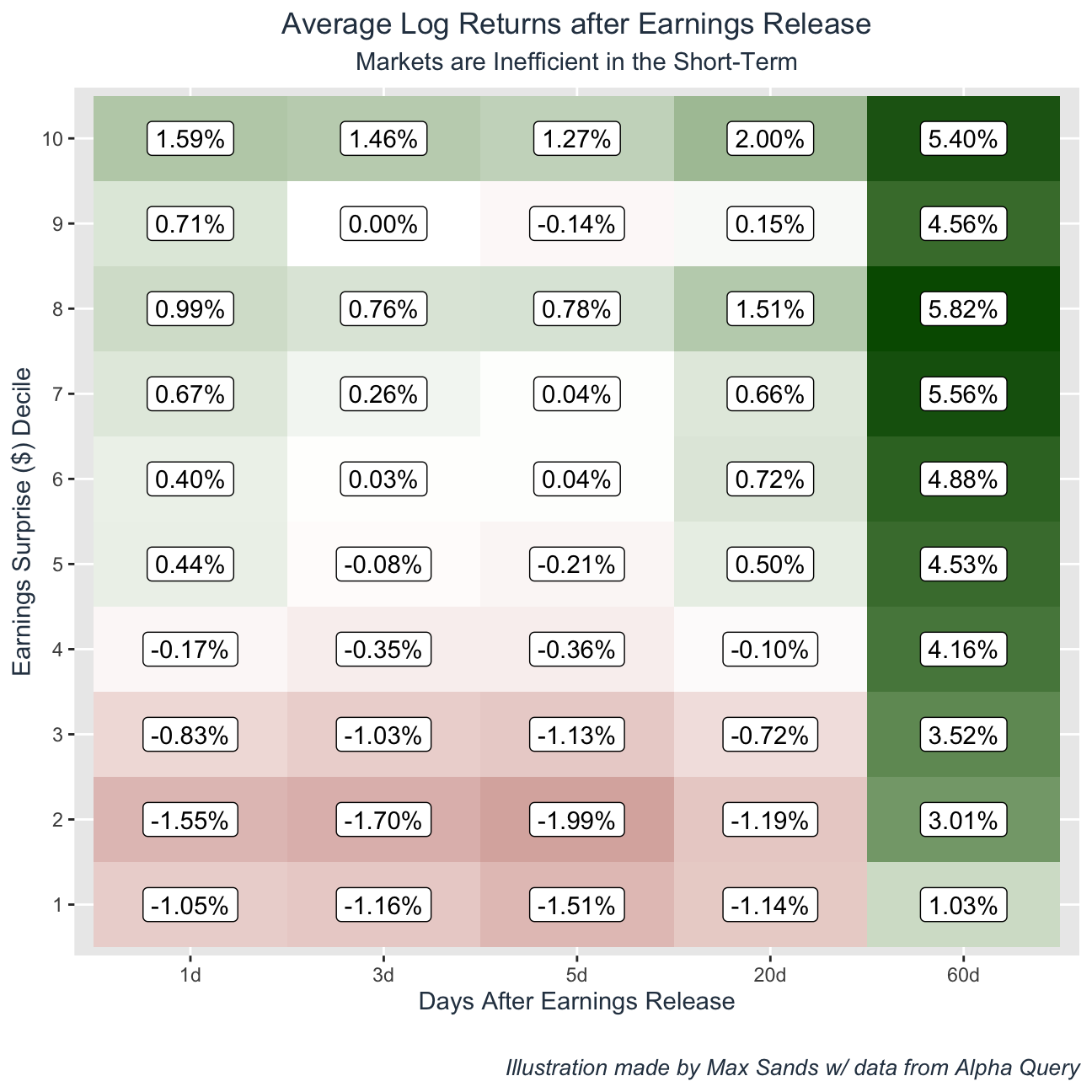

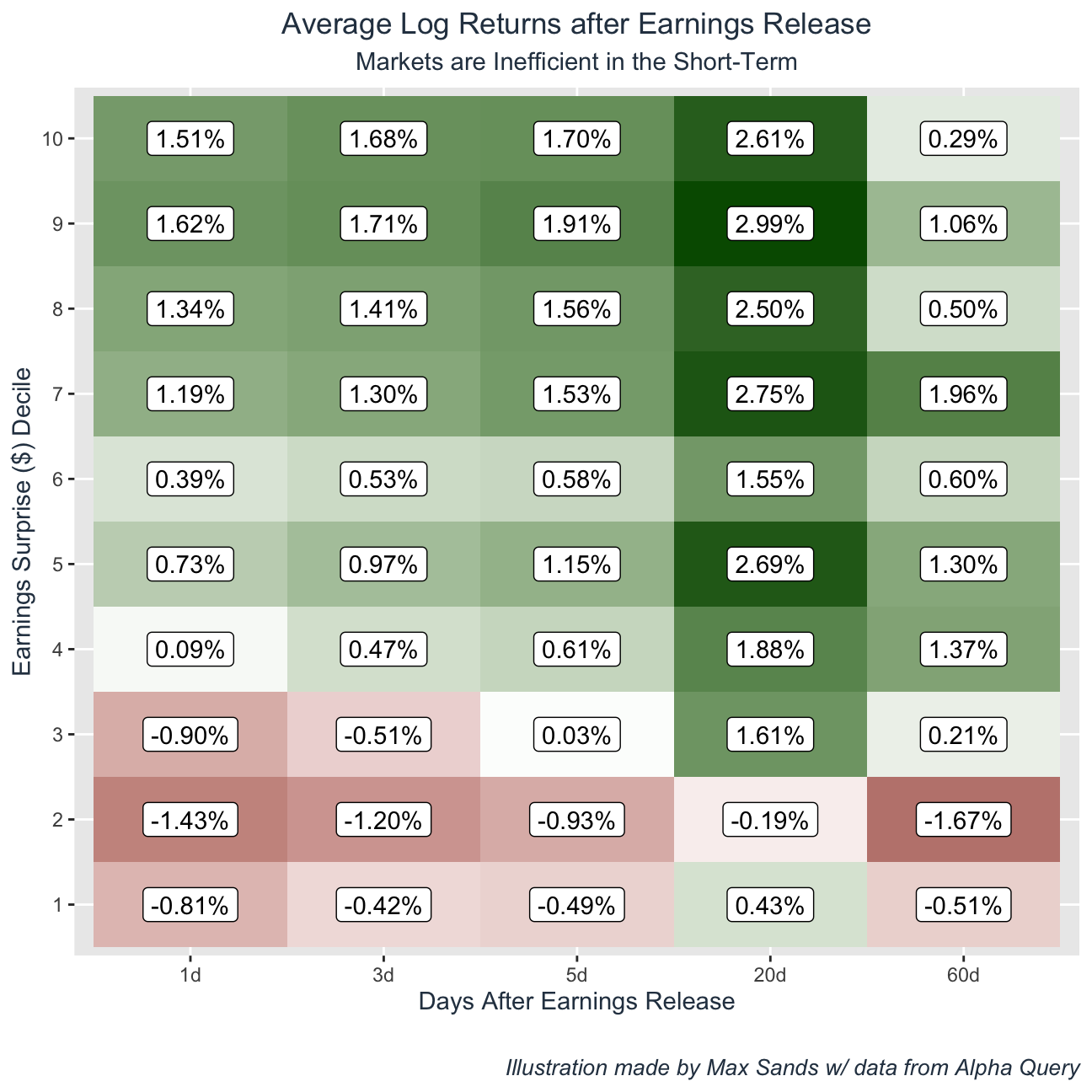

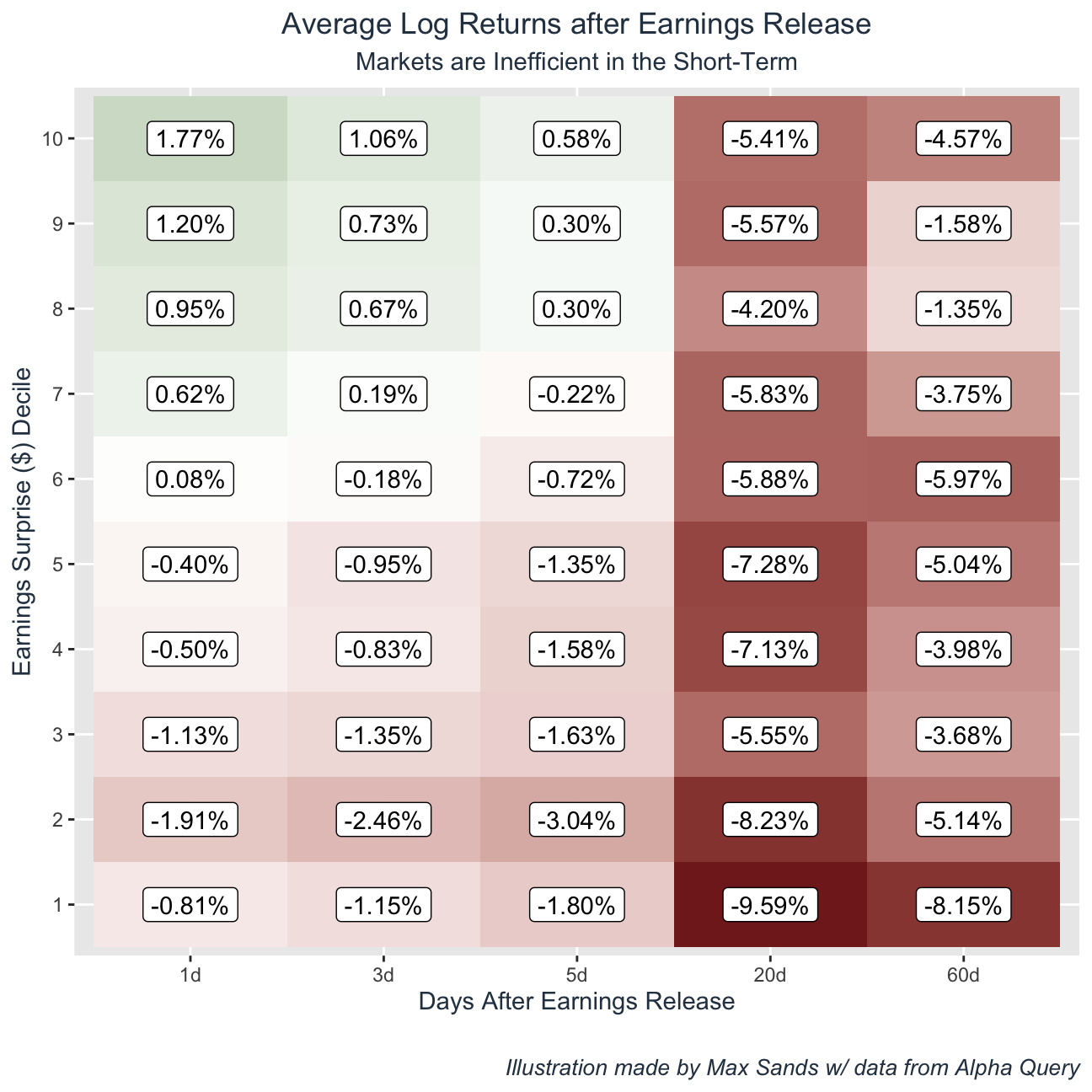

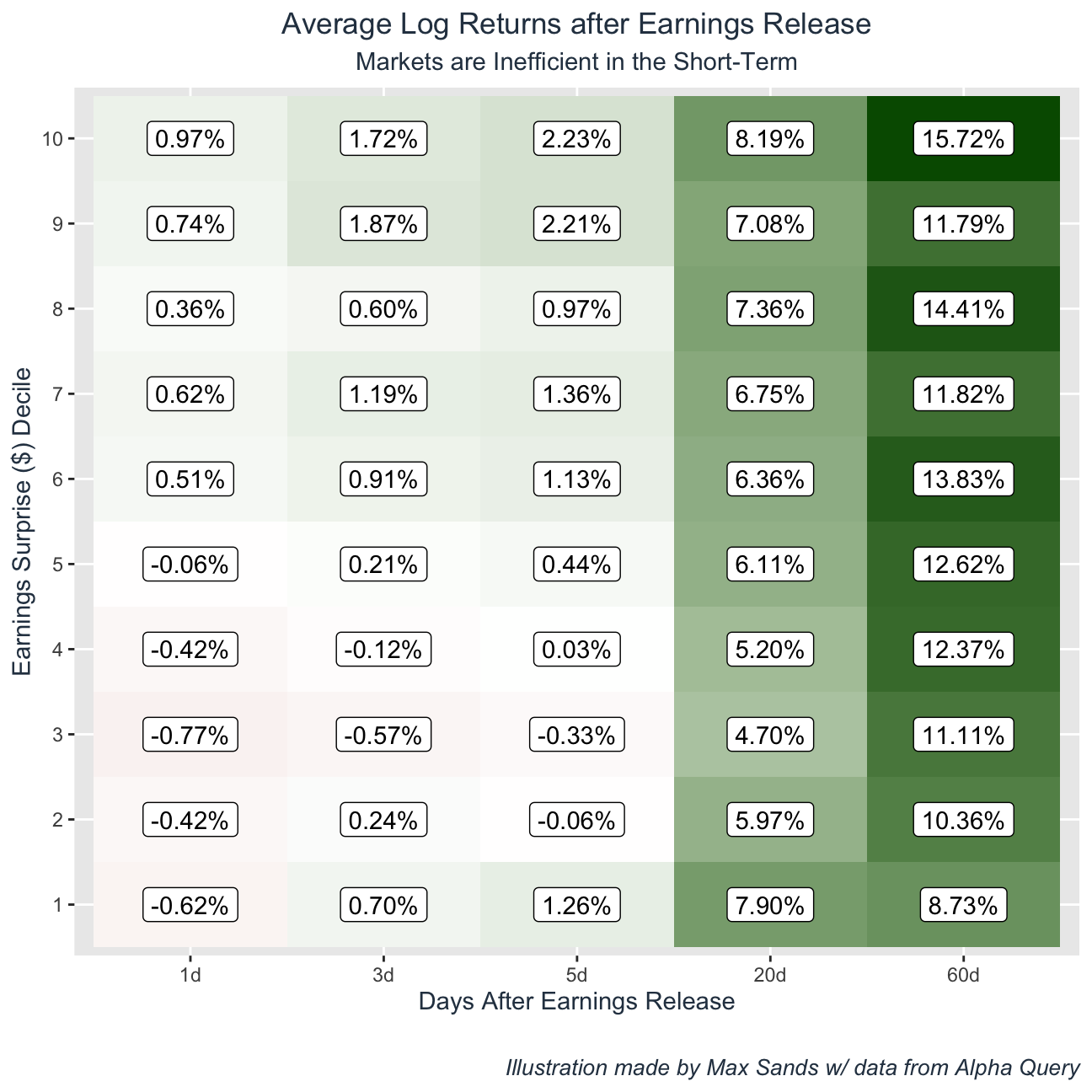

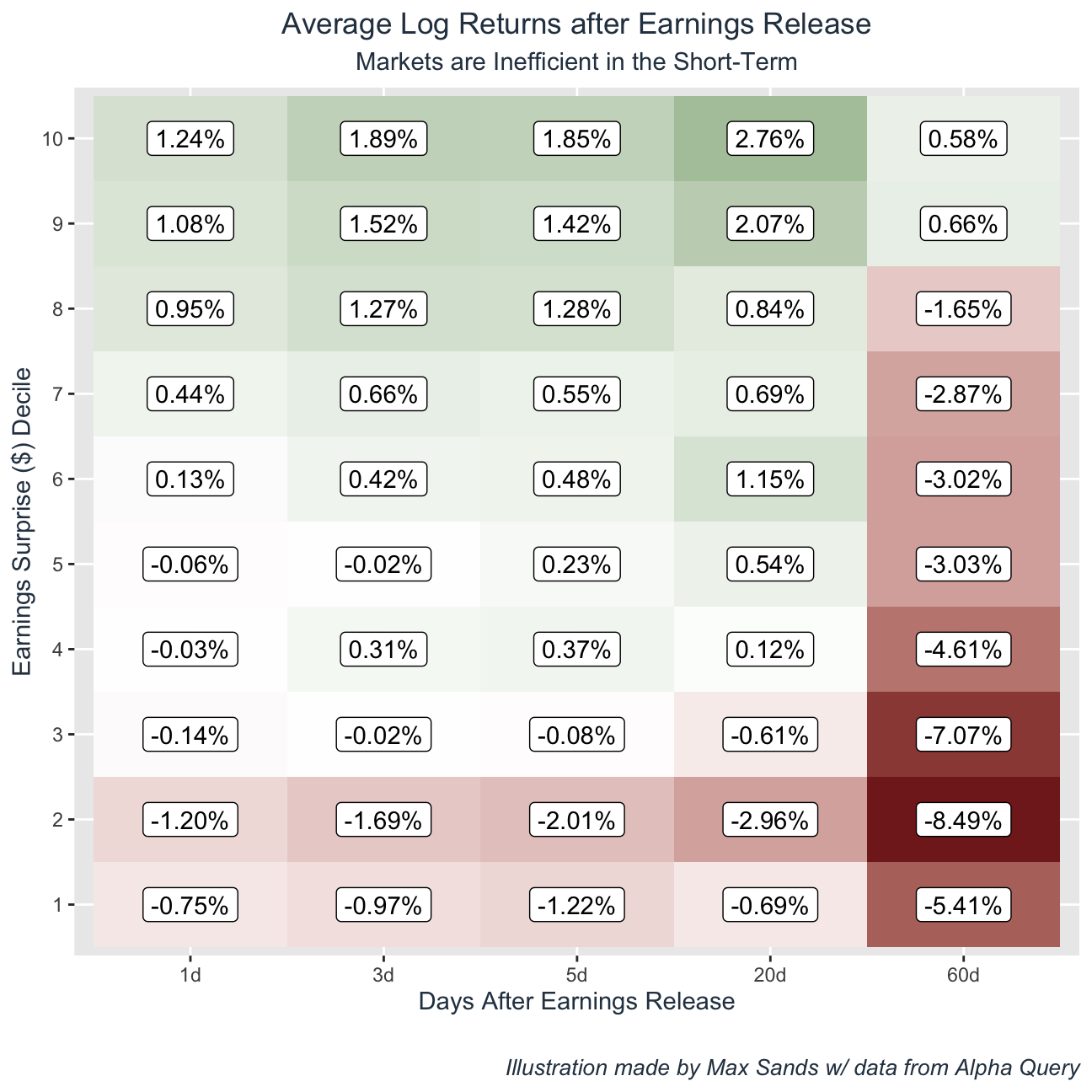

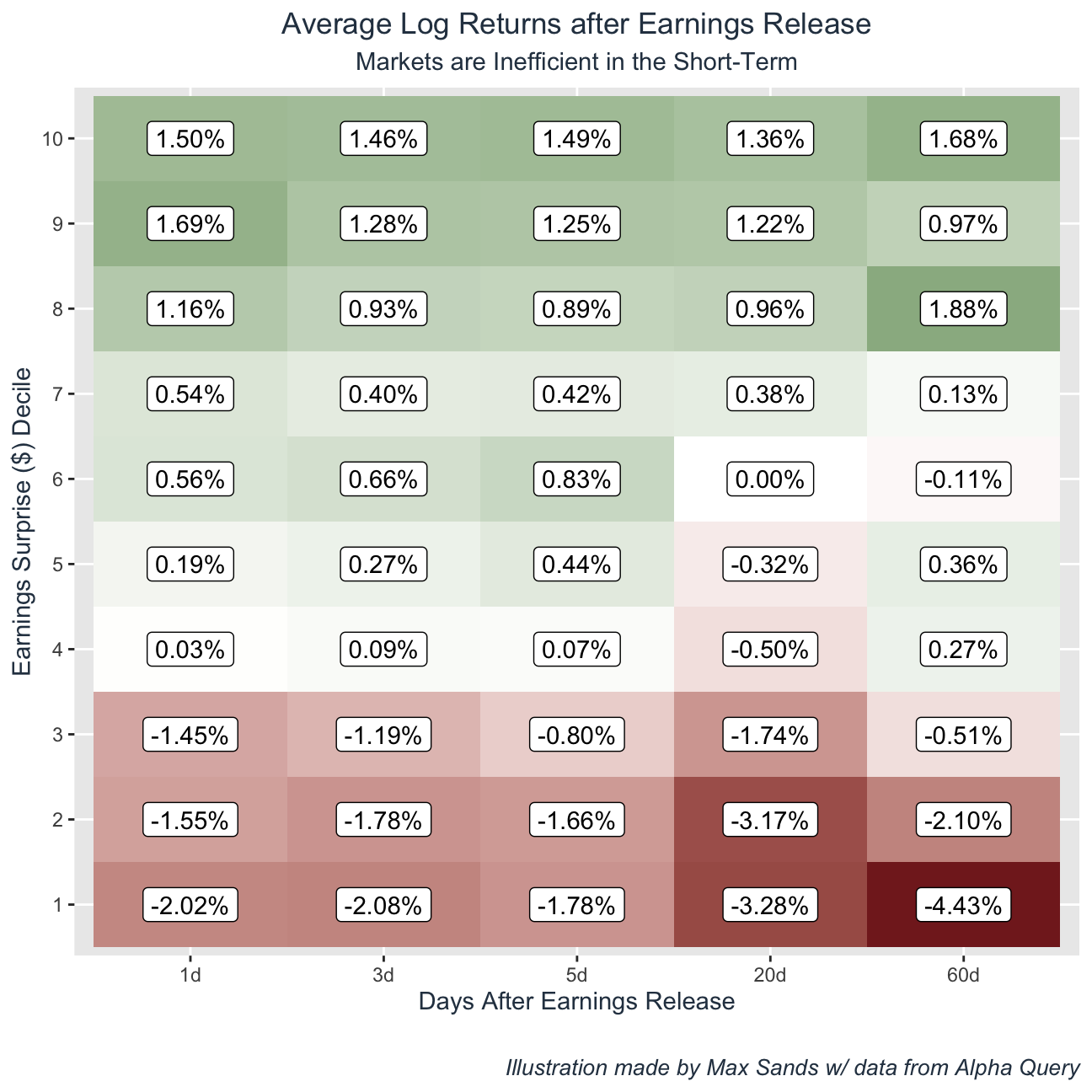

If the PEAD anomaly were to hold, we would expect to see abnormal returns following a company’s earnings release, and we would expect the returns to be dependent on the magnitude in which the company surprised on earnings. Therefore, lets bucket each observation according to the magnitude of their earnings surprise and plot the average cumulative performance of these observations 1 day, 3 days, 5 days, 20 days, and 60 days after their earnings release.

From the above heat maps, we notice that markets are inefficient in the short-term, following earnings releases. If a company’s nominal earnings surprise is in the 90th+ percentile (bucket 10), on average, the company’s stock return the next day is 1.33%! Conversely, if a company’s nominal earnings surprise is in the 0-10th percentile (bucket 1), on average, the company’s stock return the next day is -1.09%!

Interestingly, we notice that the PEAD anomaly is more distinguished when measuring earnings surprise in nominal dollars rather than percent change, which is slightly un-intuitive.

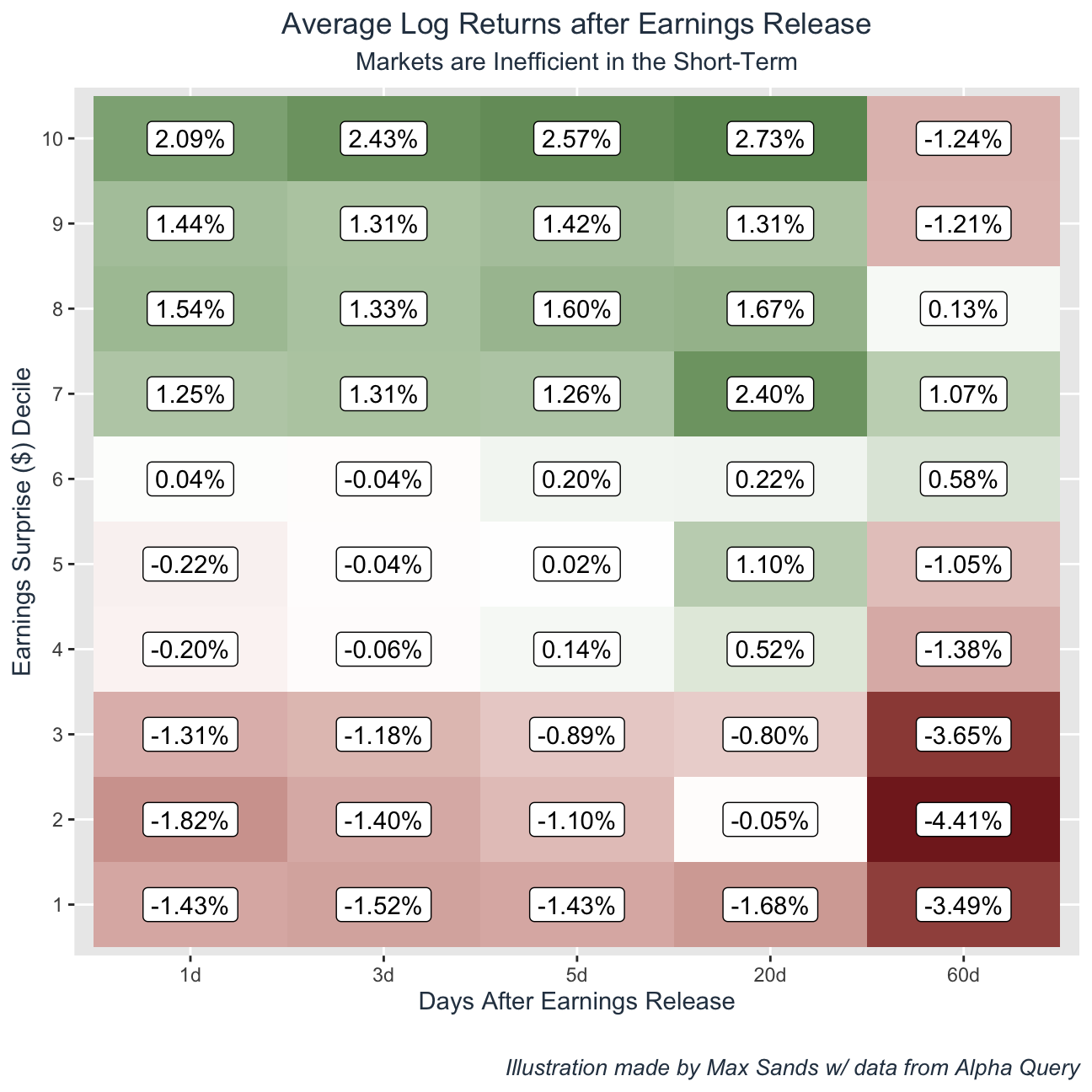

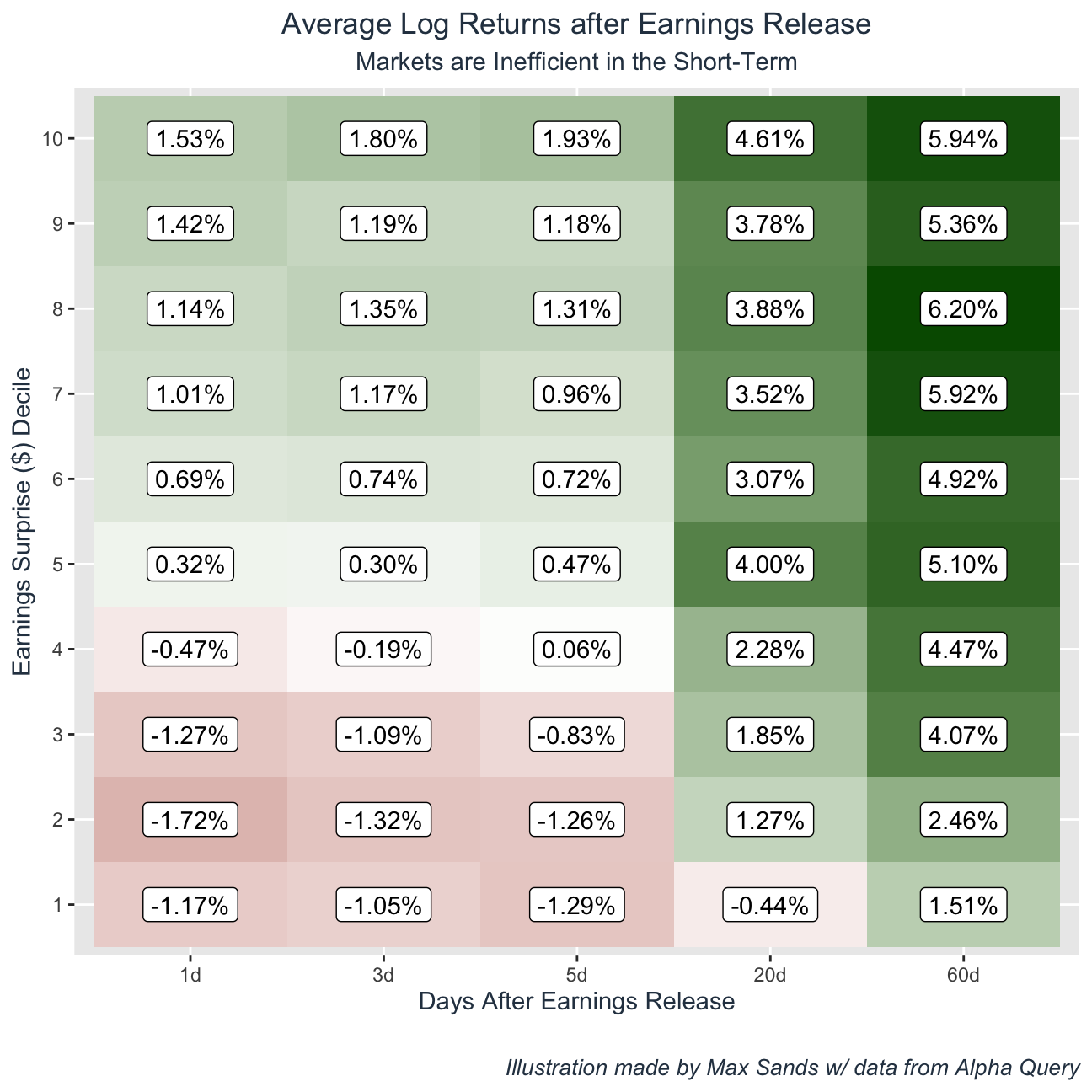

While the above heat maps represent averages of all the data since 2015, it is also a good idea to make sure that we observe the PEAD anomaly for each individual year:

It is clear that the PEAD anomaly is prevalent throughout time, especially in the extreme short-term (1 day post-earnings release).

Return Cyclicality

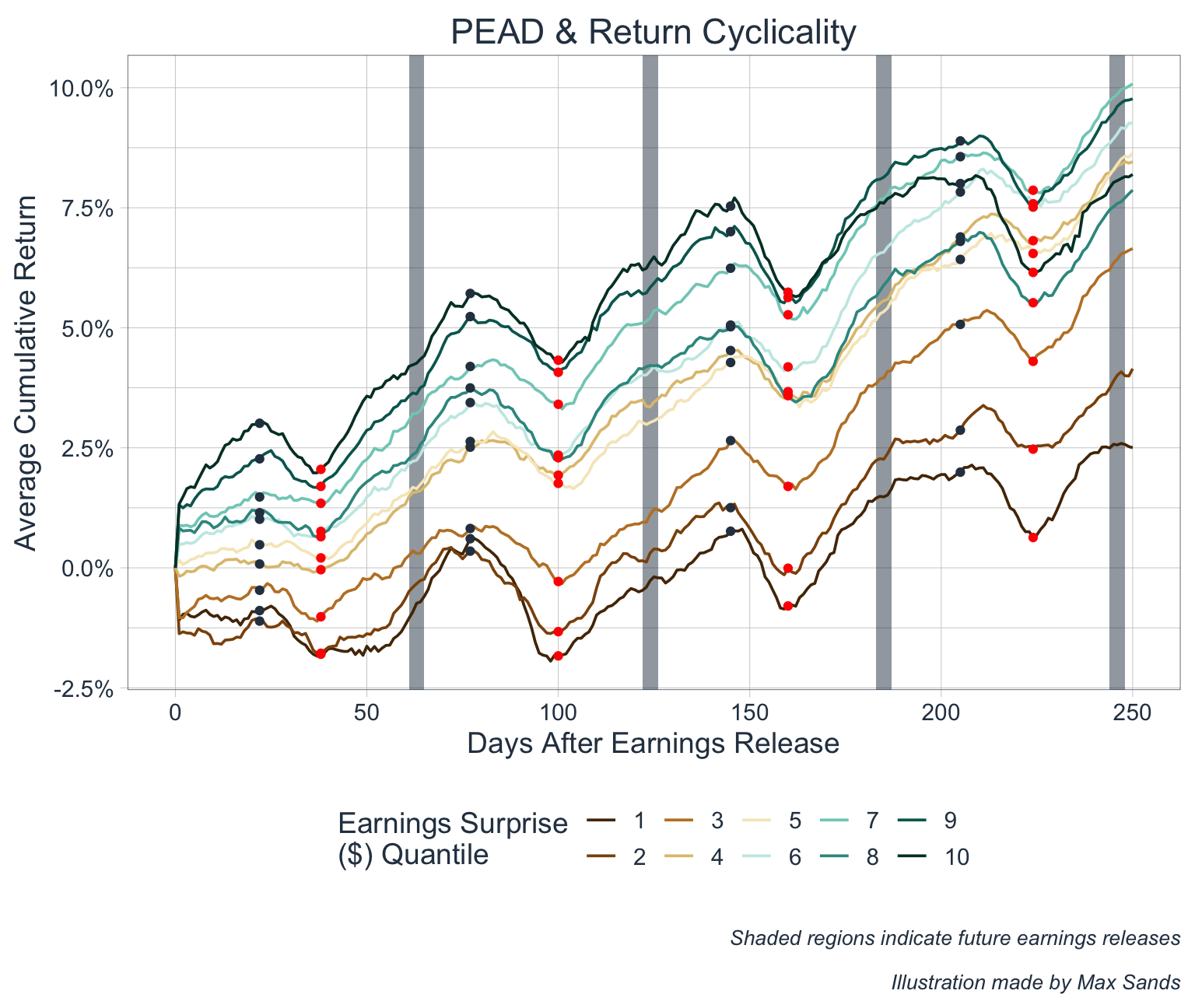

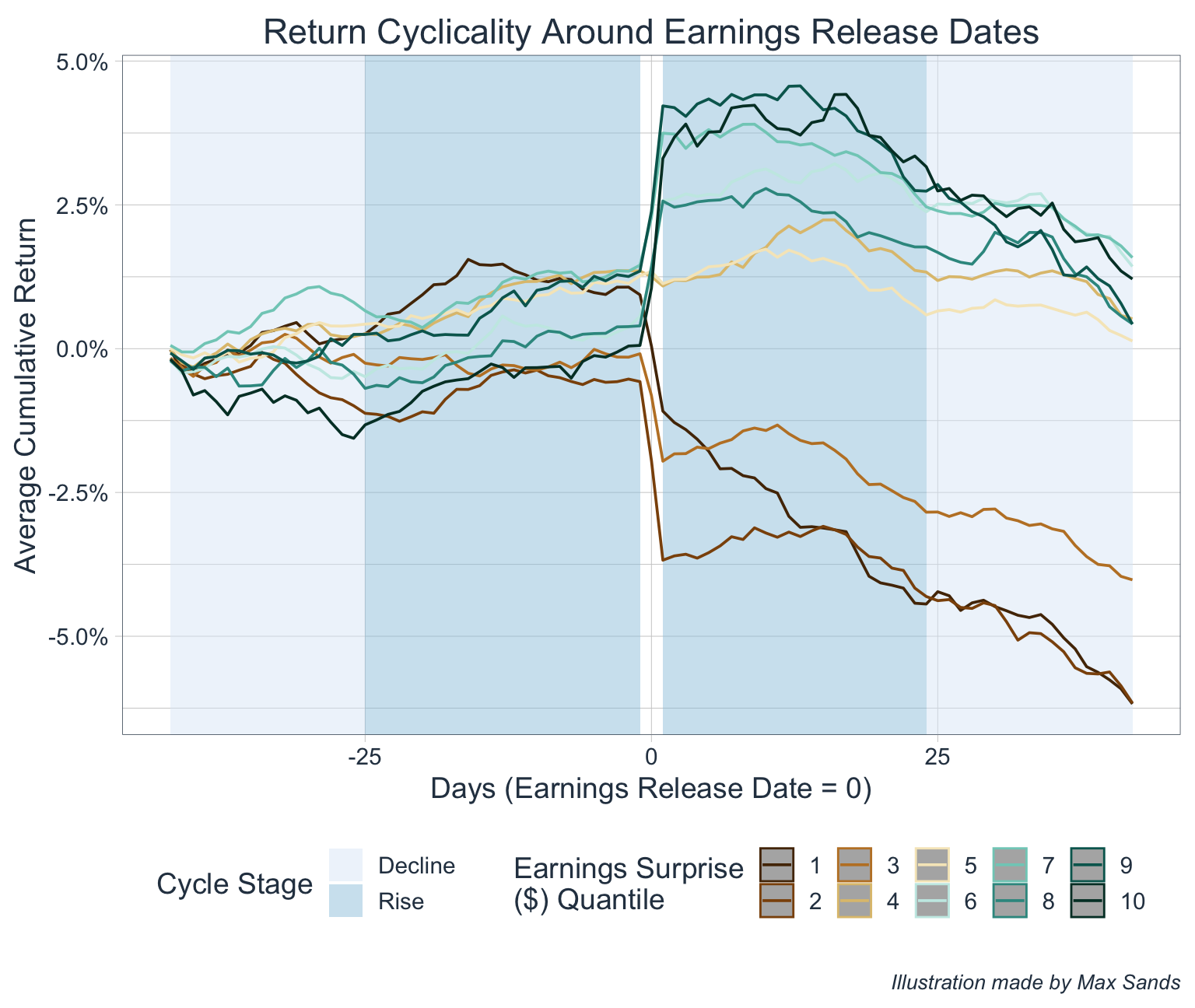

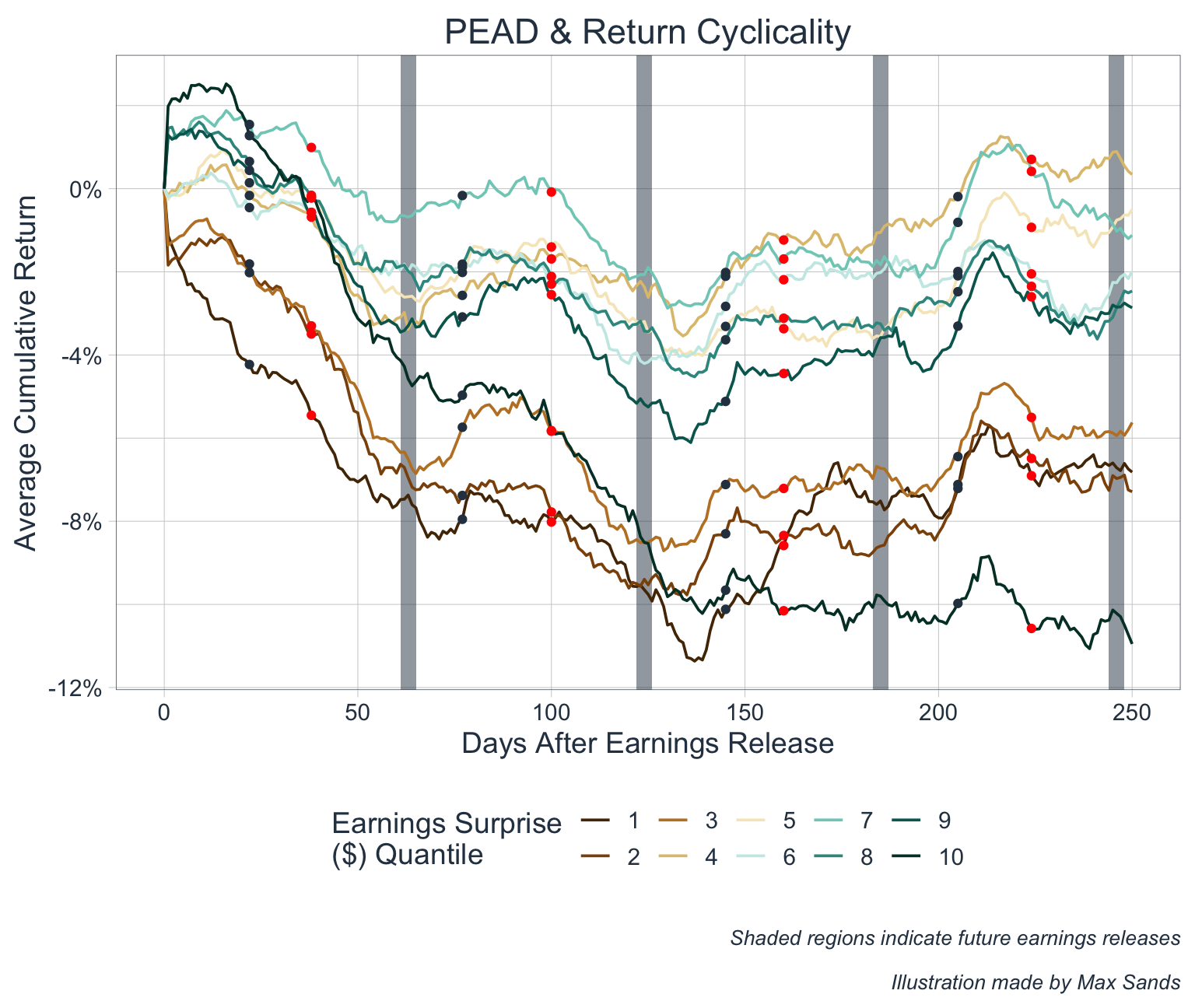

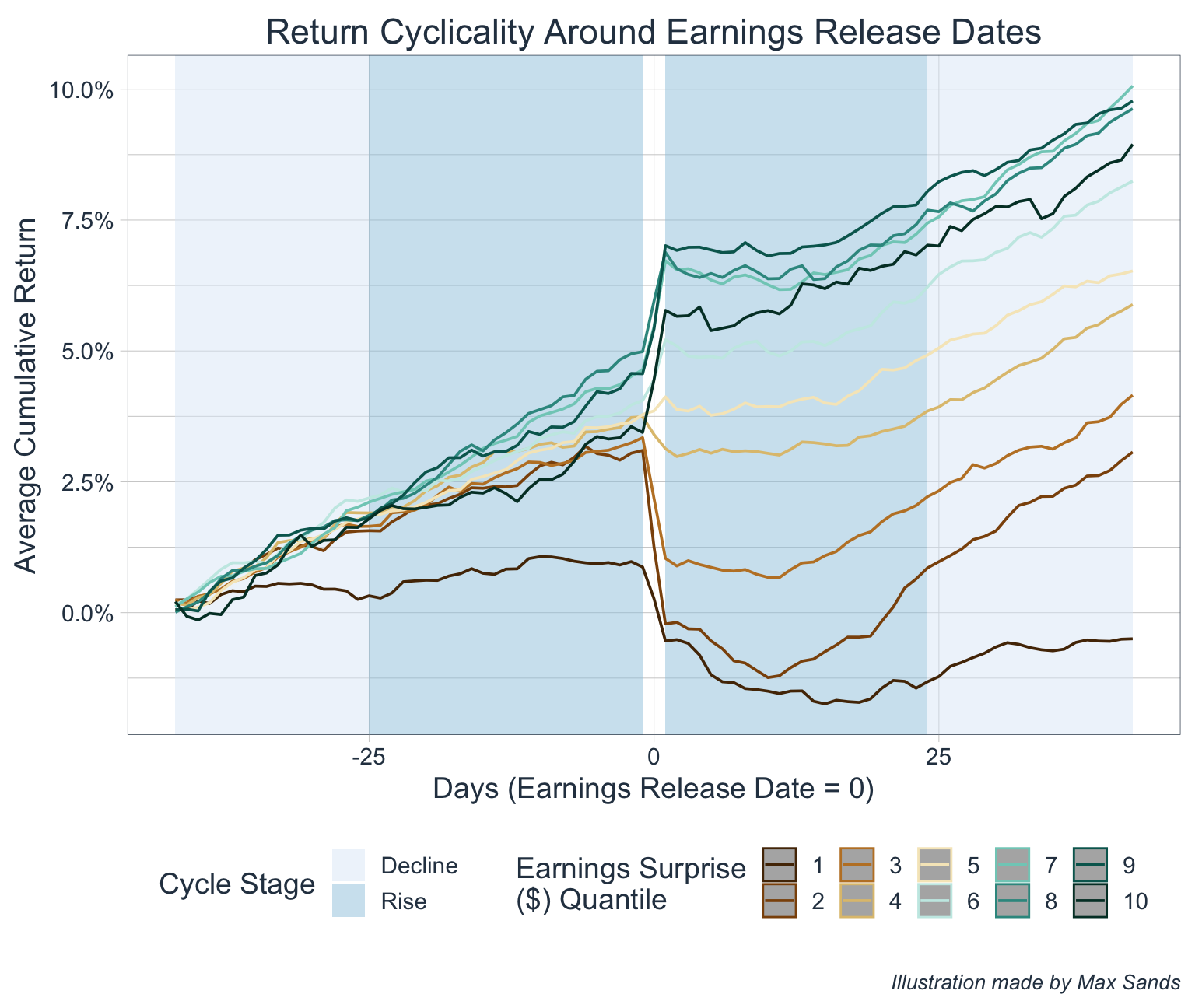

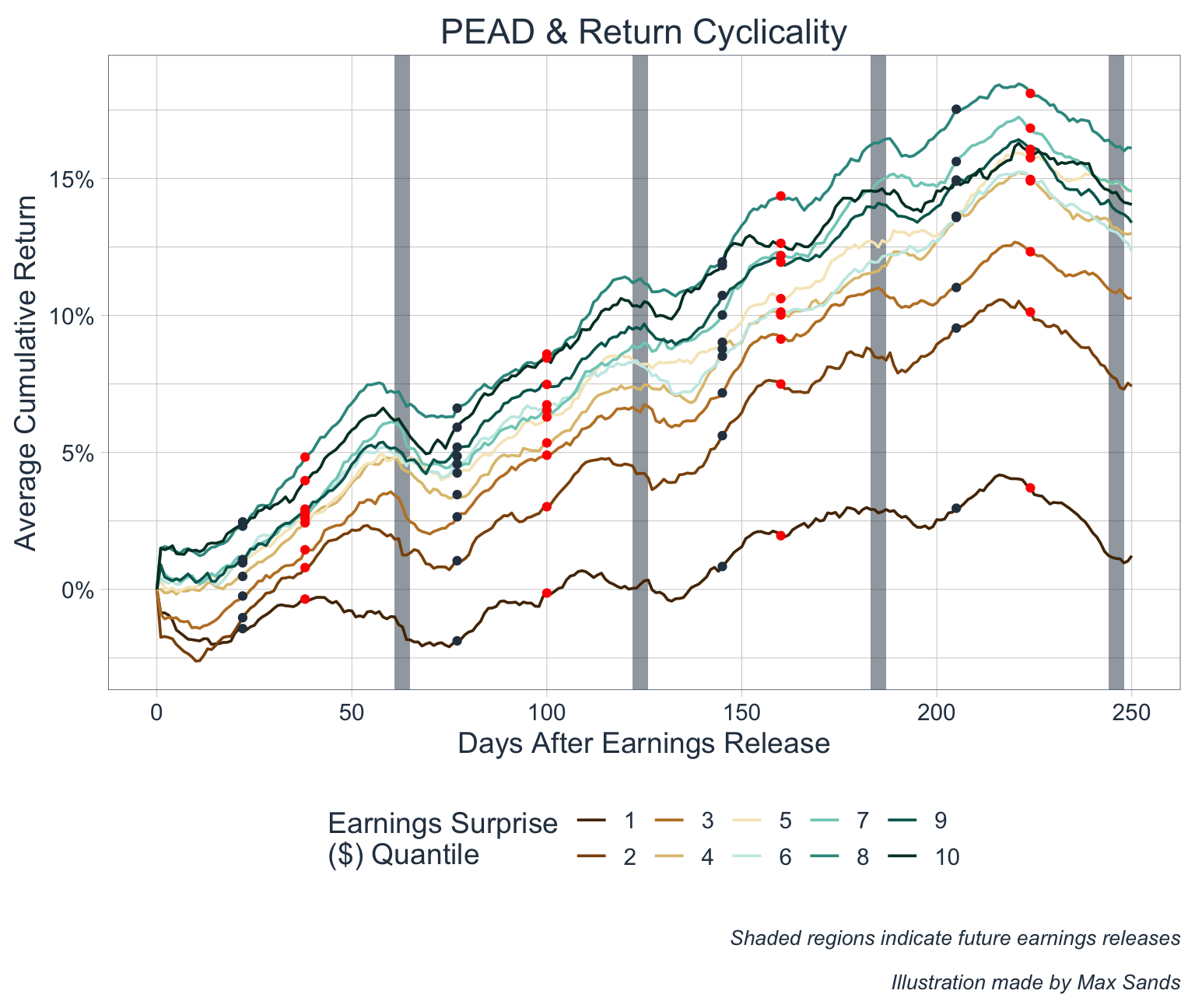

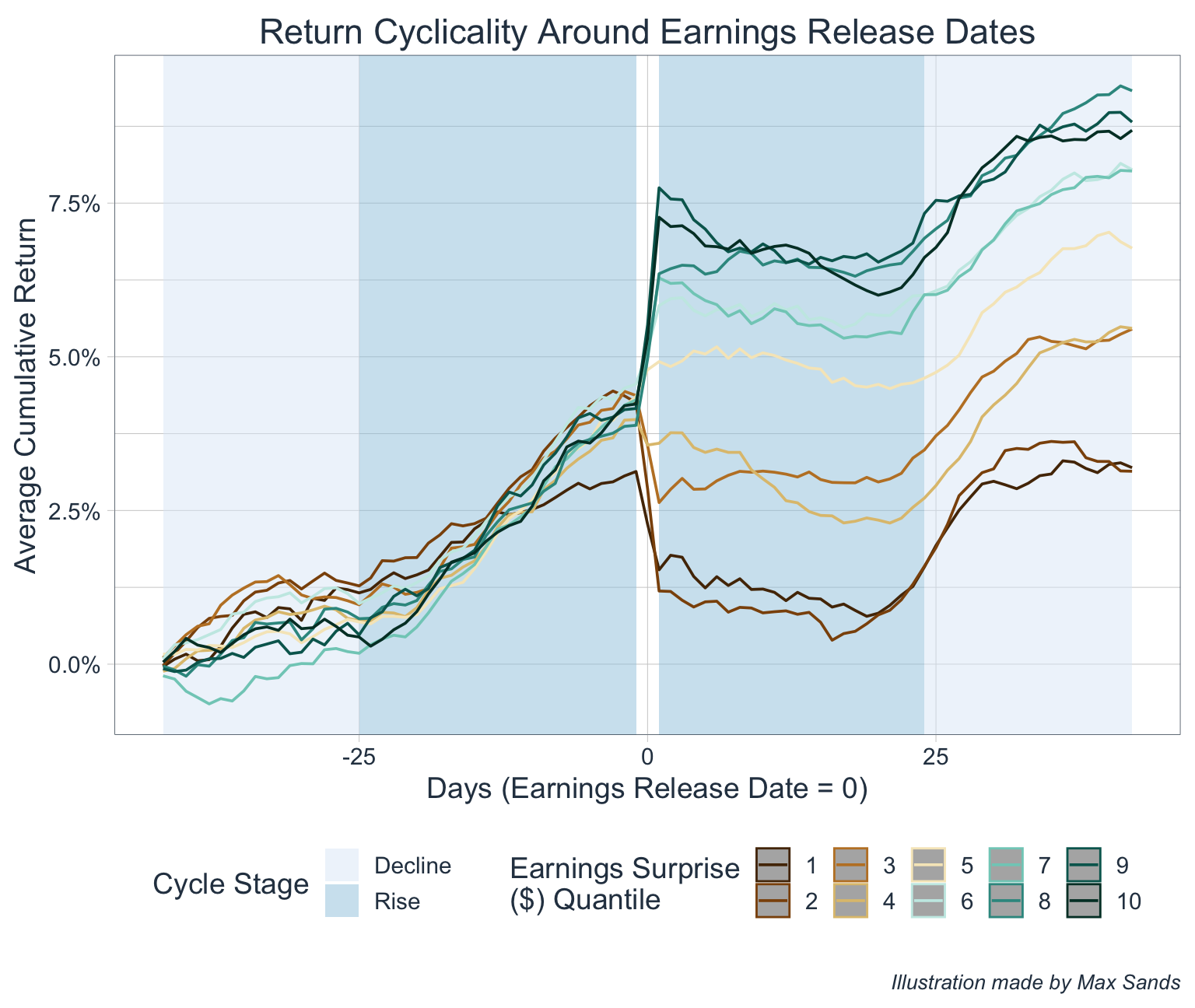

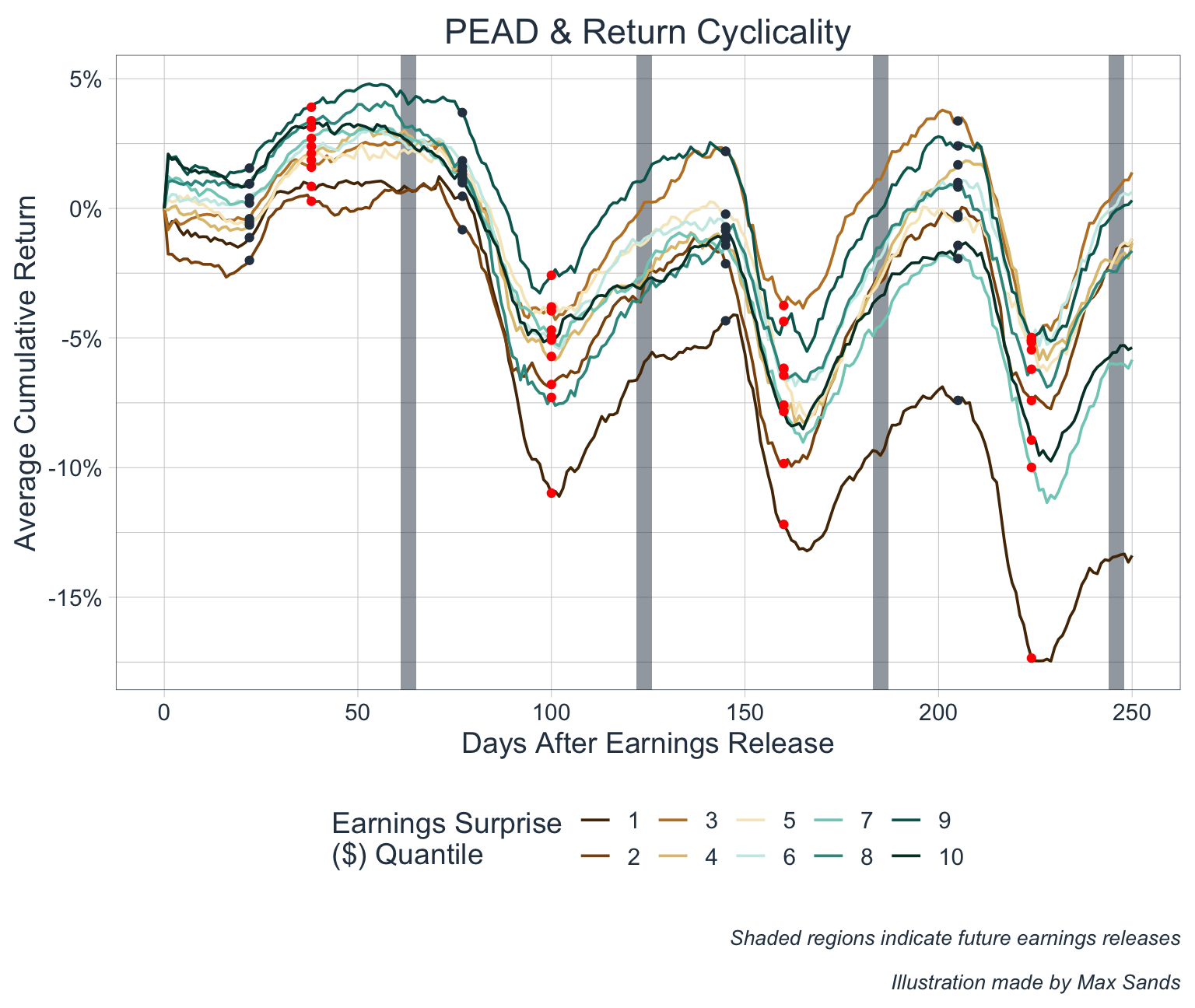

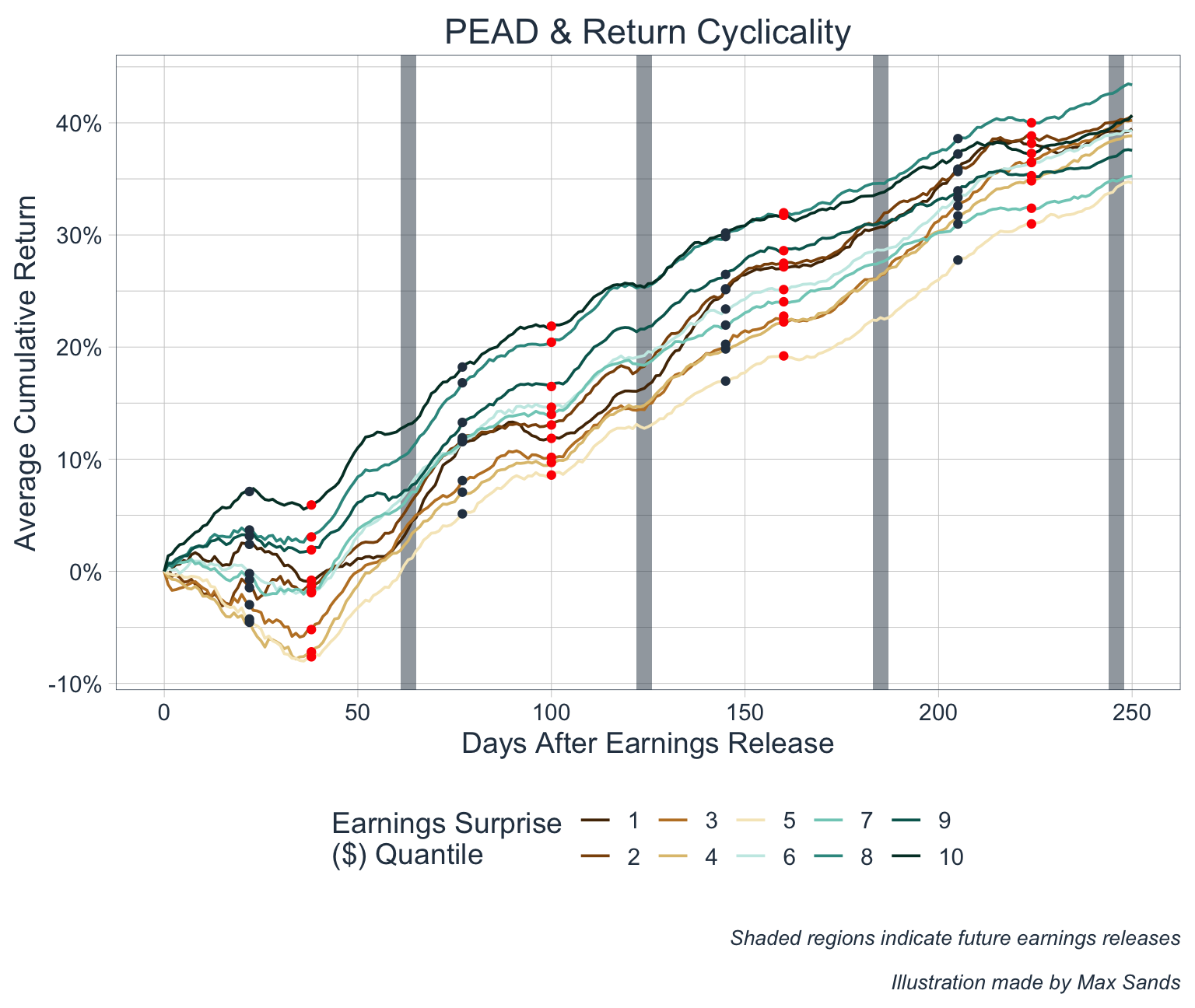

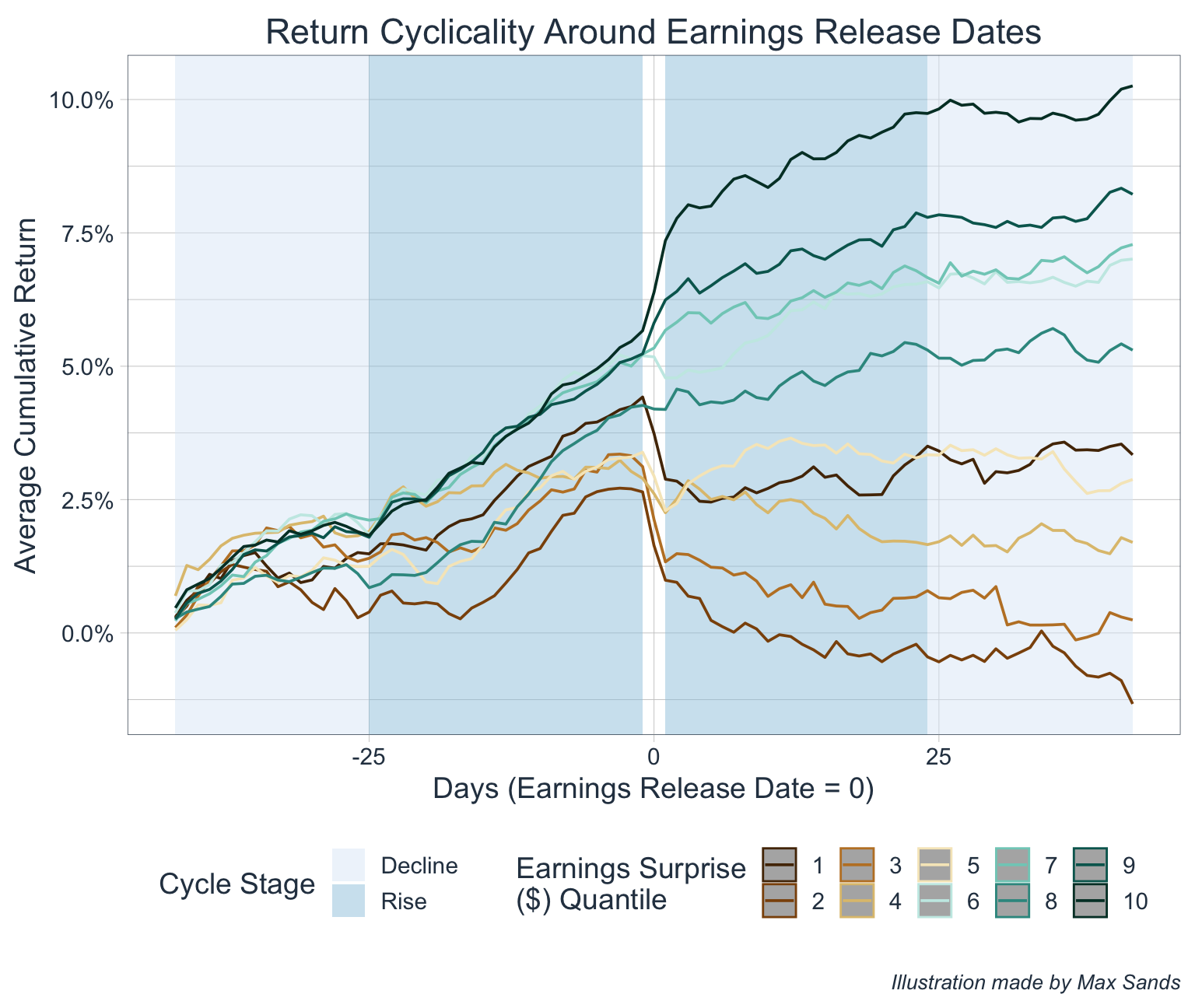

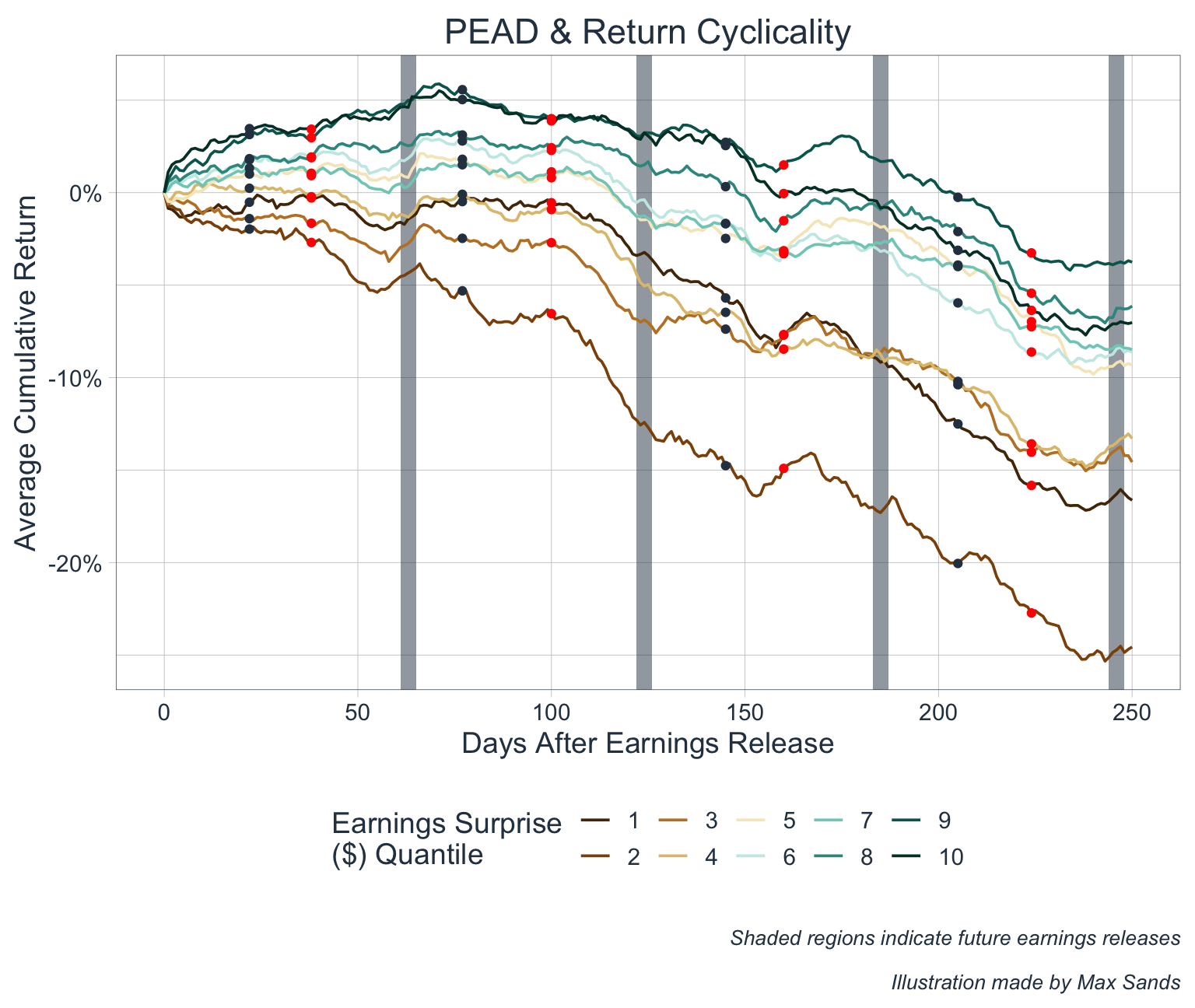

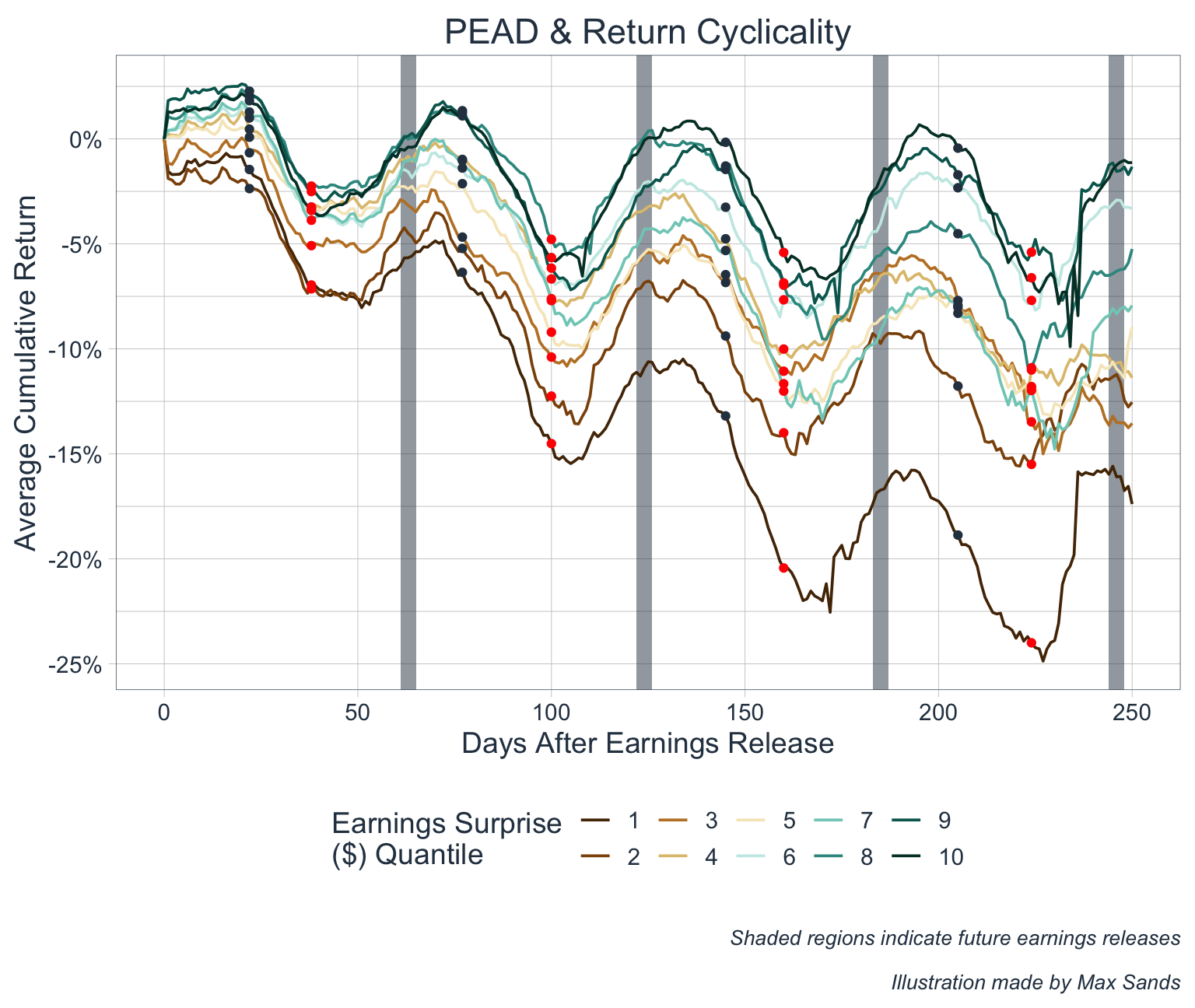

In the above, we inspect the average log returns of companies discretely 1, 3, 5, 20, and 60 days after their earnings releases, but it may be helpful to visualize the average cumulative performance over a continuous 250 day time-span:

The above plot is astonishing as it depicts an idiosyncrasy that is not visible in a heatmap - stock returns, on average, are cyclical. We can see that if we divide a fiscal quarter into 3 equal parts, stock prices rise during the first 3rd, decline during the second 3rd, and rise again during the last third.

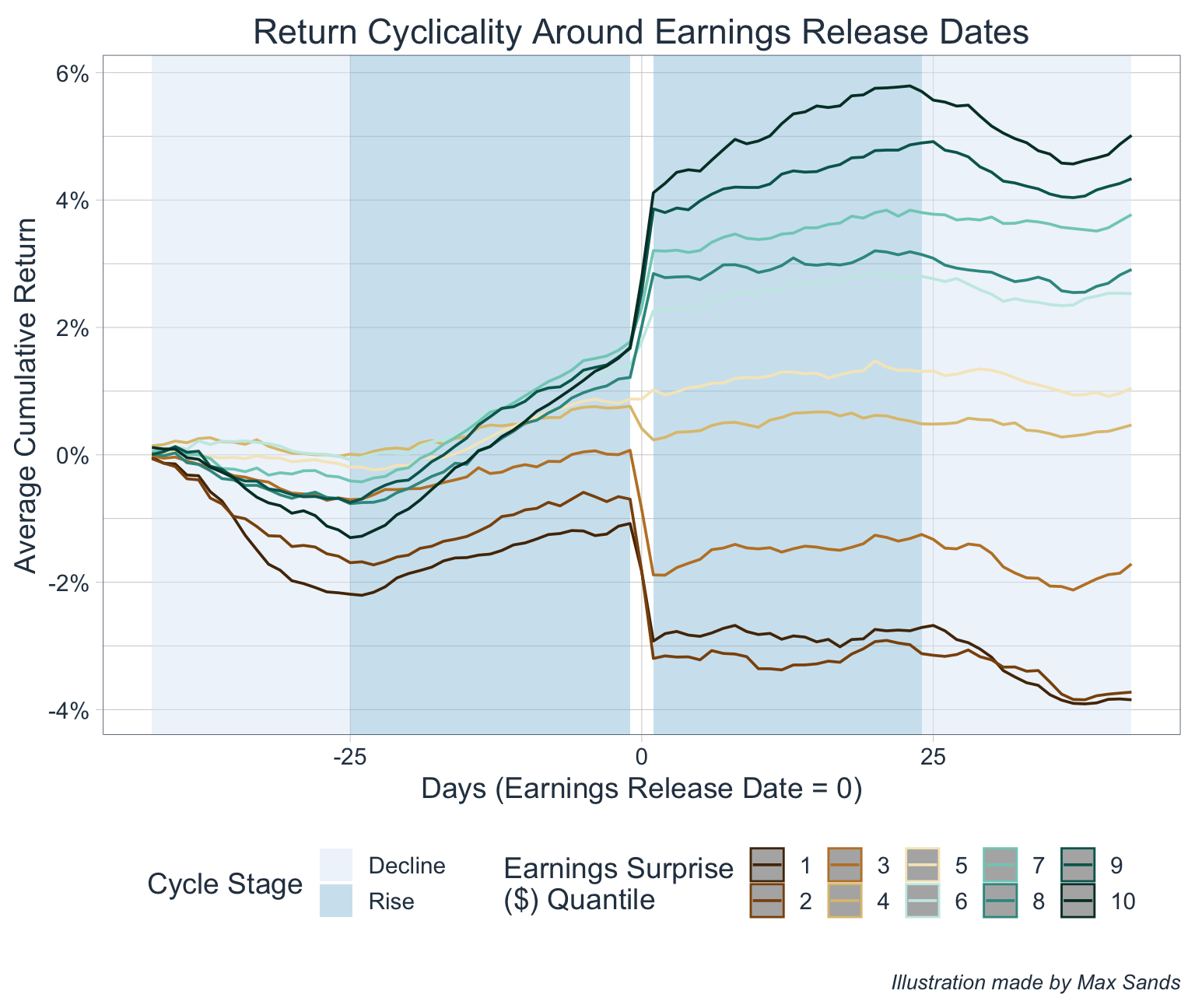

Let’s visualize a single cycle:

Once again, it is difficult to find a rational explanation for this behavior. A possible explanation is that from time t = -25 to t = 0, investors optimistically anticipate earnings releases, which drive stock prices up. It is interesting to note that the stocks who rise the most in this time-period tend to have the largest earnings surprise. Then, at t = 0 the company releases earnings and the price quickly jumps up or down according to the magnitude and direction of the earning surprise, until t = 1. This demonstrates the magnitude of 1 Day PEAD. Subsequently, from t = 1 to t = 25, the companies who beat on earnings continue to see a slight trend upwards, perhaps because investors underestimated the importance of the positive earnings surprise. Lastly, after t = 25, we see a reversion from the gains exhibited in the previous stage of the cycle, and the cycle repeats itself…

Again, the above chart is an average of more than 20,000 observations, so the prevalence of this return cyclicality is unlikely to be a fluke, but there is certainly variation between individual years. Let’s investigate each year in isolation:

Improving the Analysis

The analysis above paints a rough picture of the PEAD Effect & Return Cyclicality, but it has 2 clear caveats:

- It does not compare stock performance to a benchmark

- It does not distinguish the impact of After-Market Trading on the magnitude of the PEAD Effect

In the following, we will include only SP500 companies, and account for these caveats:

Comparing Performance to a Benchmark

Rather than assess nominal performance, we will now calculate performance relative to the SP500. To do this, we will create a new metric called Abnormal Return which is calculated as follows:

\[ AR = Return_{(i,\ t)} - B_i(Return_{(SP500, \ t)}) \]

where i represents the ith company, t represents the time period, and B represents the stock’s Beta.

To be clear, a company’s Beta can be thought of as follows - if the market (i.e. SP500) moves +1% in a day, on average, the company moves B%. Therefore, in the above, we are calculating each company’s daily returns in excess of a basic expectation.

Assessing the Impact of After-Market Trading

It is important to note that rather than executing a trading halt and releasing earnings during trading hours, most firms release earnings during after-market hours. As such, we would expect much of the stock price movement to occur during after-hours trading. In the above, daily returns were calculated between closing prices of consecutive days which implicitly includes stock price movement that occurs after-hours, but we should compare stock price movements when removing the effect of after-hours trading.

To do this, we will replace the return for each day after an earnings announcement with the return that occurs between the open and close. This will allow us to distinguish the amount of stock price movement that is realized after-hours.

Visualization

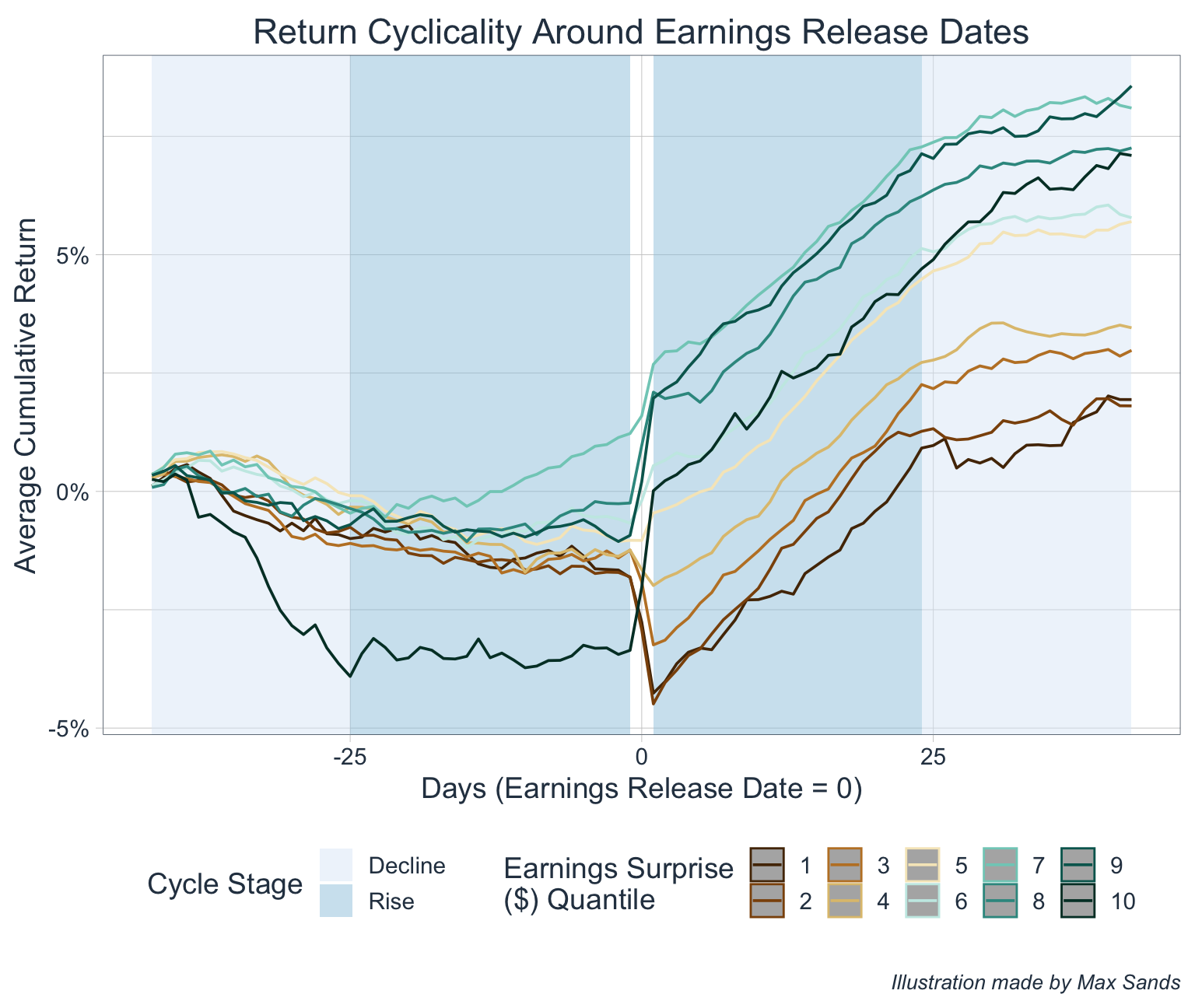

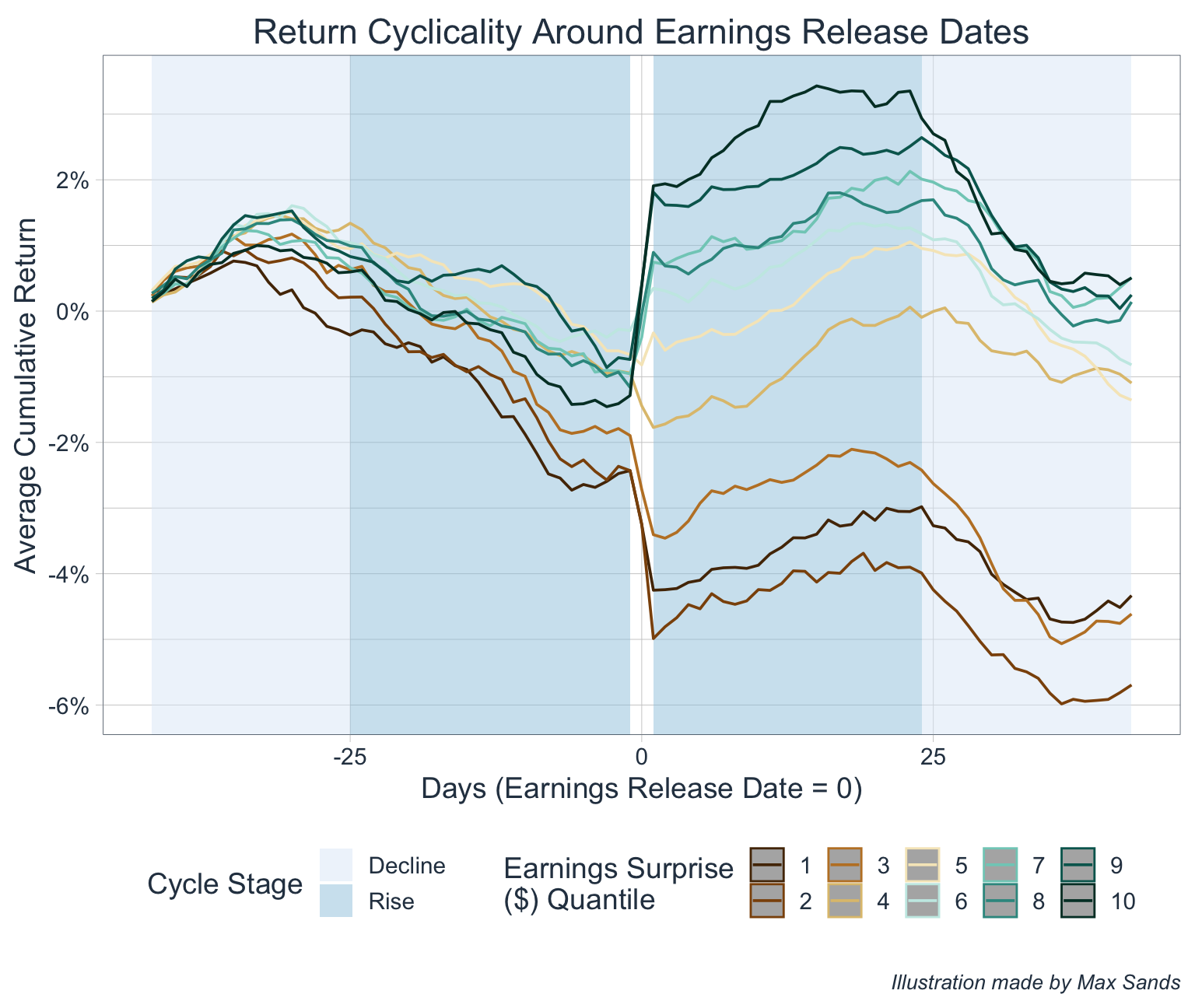

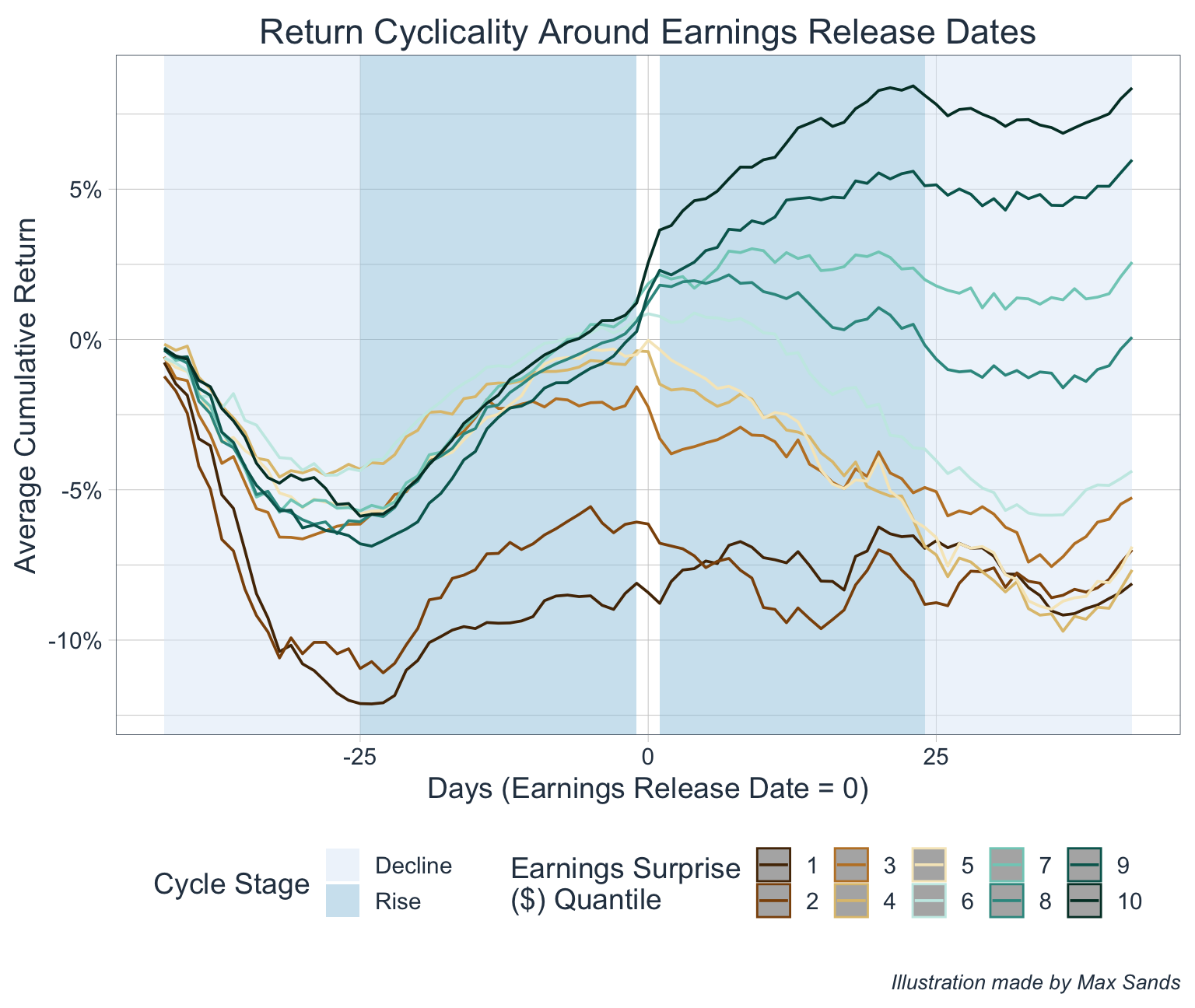

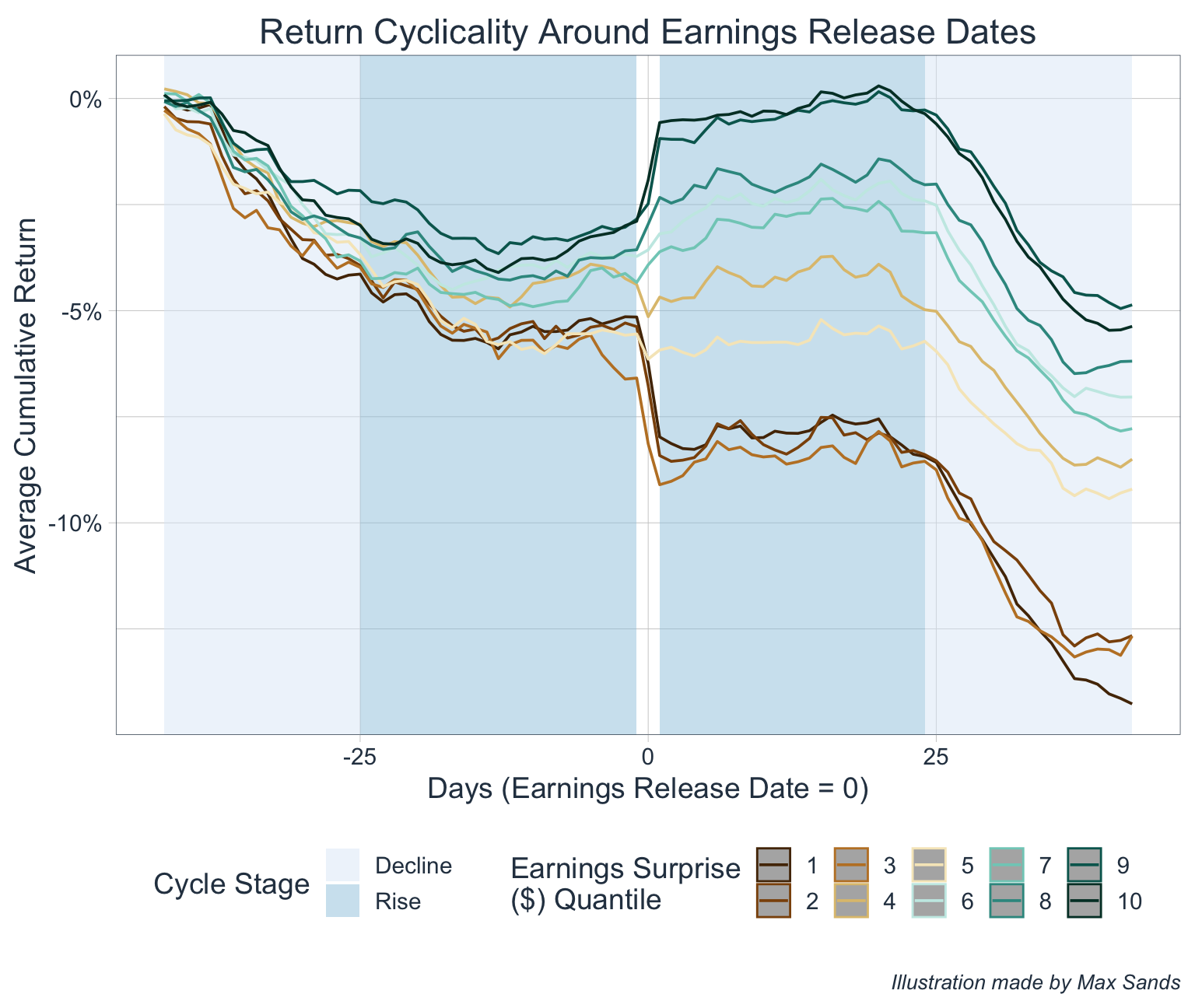

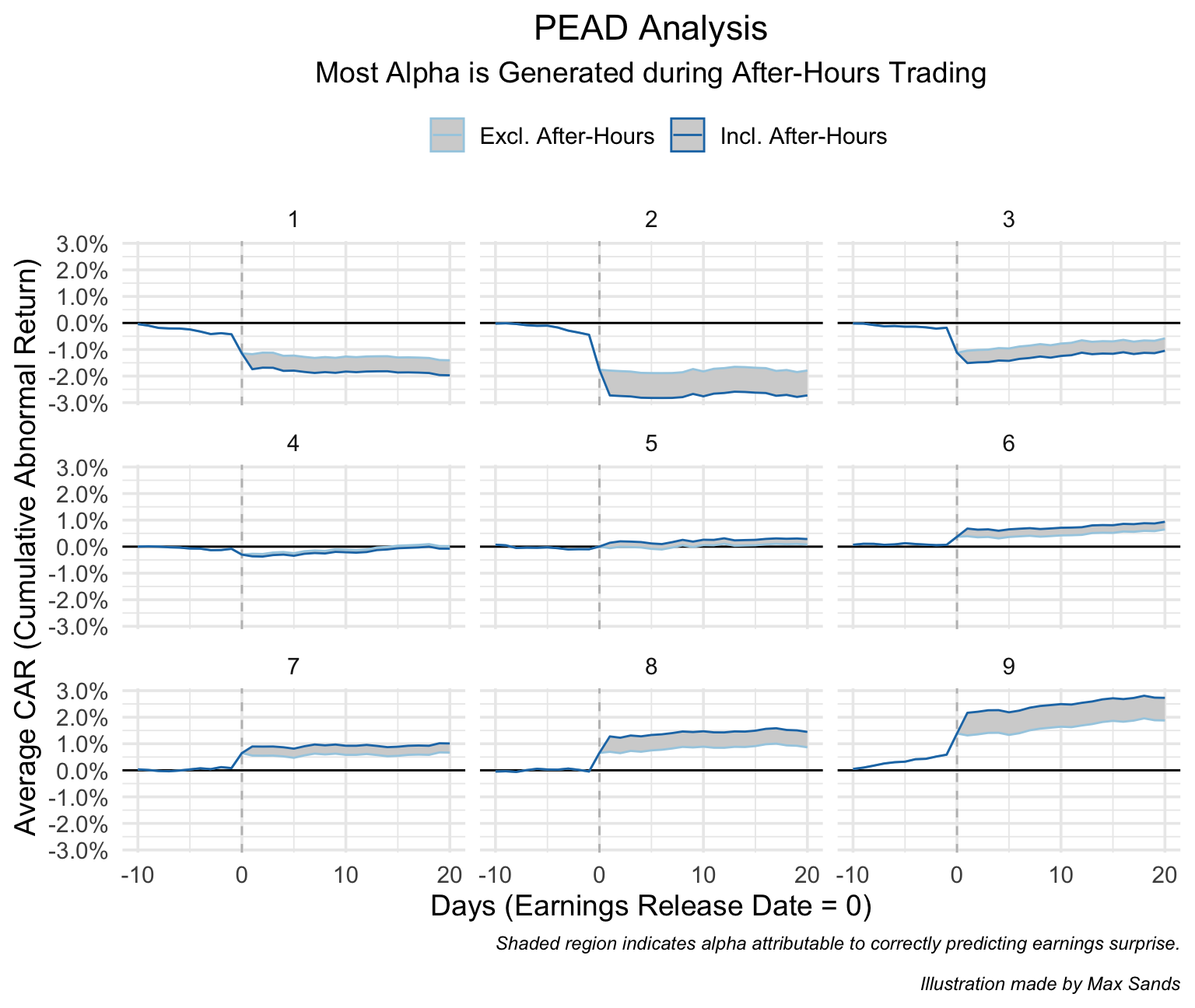

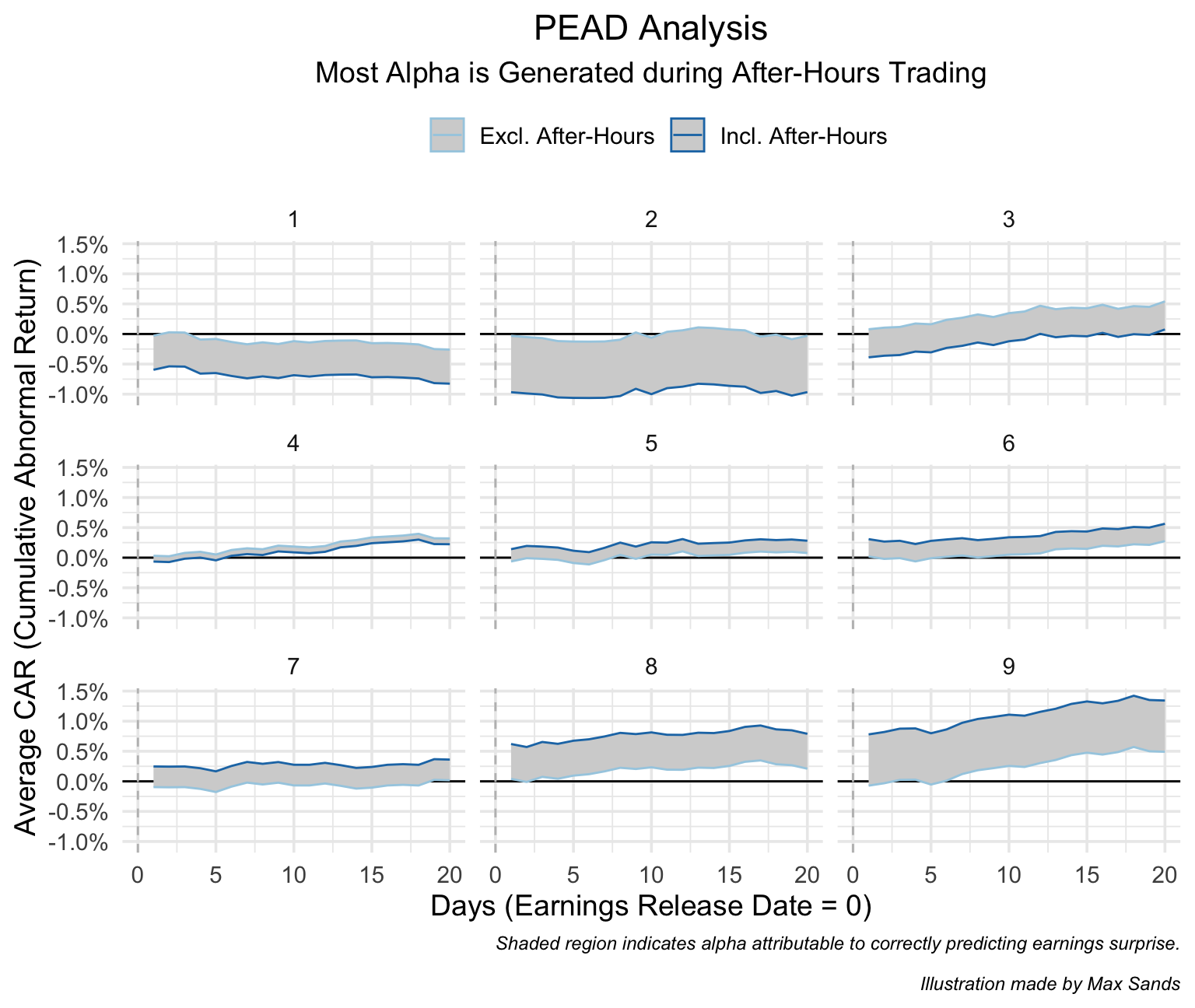

After accounting for the above, we can again visualize company returns around earnings announcements:

The plot above demonstrates a few key points:

- The majority of alpha is generated during after-hours trading

- This is logical as we would expect the quantitative investment firms with fast computers to act quickly on this new information.

- For the most extreme earnings surprise observations (buckets 1 & 9) the market appears to somewhat expect these results in the days leading to the earnings release.

- In comparison to our previous plots, the PEAD effect is less noticeable when considering SP500 companies only which indicates that PEAD is more pronounced for smaller companies.

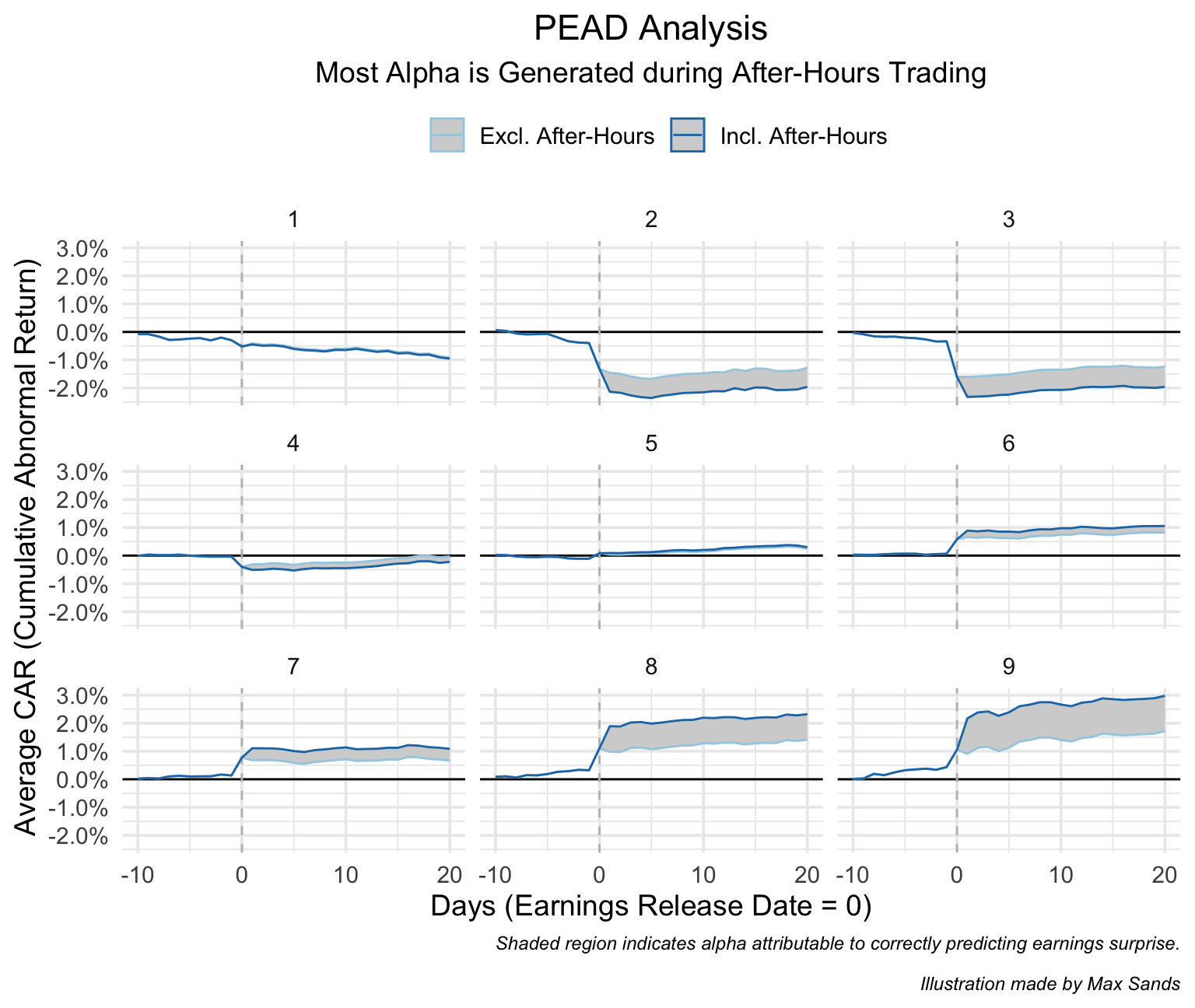

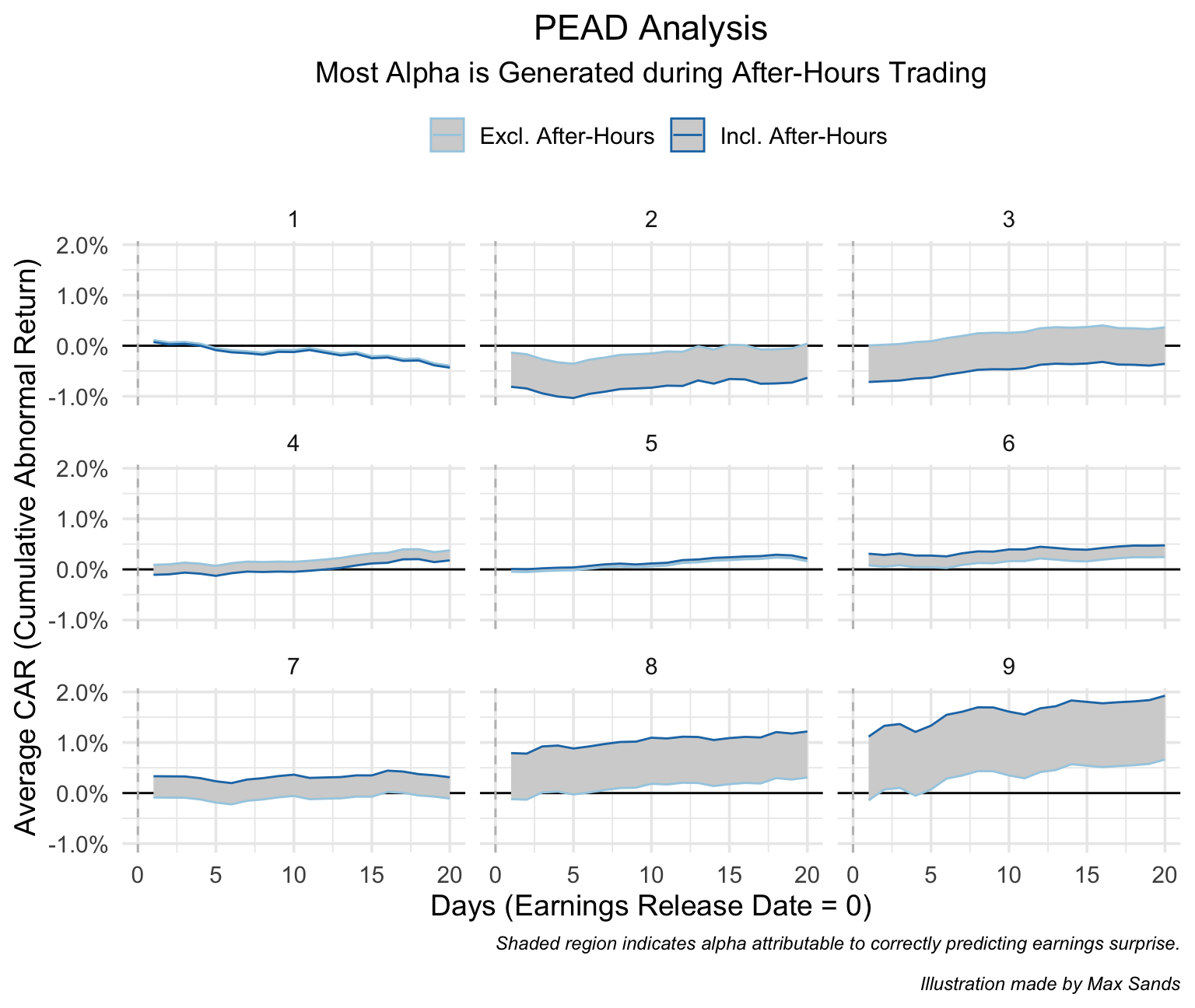

I would also like to point out that the variation that occurs at t = 0 (Earnings Release Day) is abnormal and it is likely due to the fact that some companies release earnings in the morning. However, I was not able to gather information regarding the time of announcement. Therefore, this variation should be ignored. Let’s visualize average CAR starting at time t = 1.

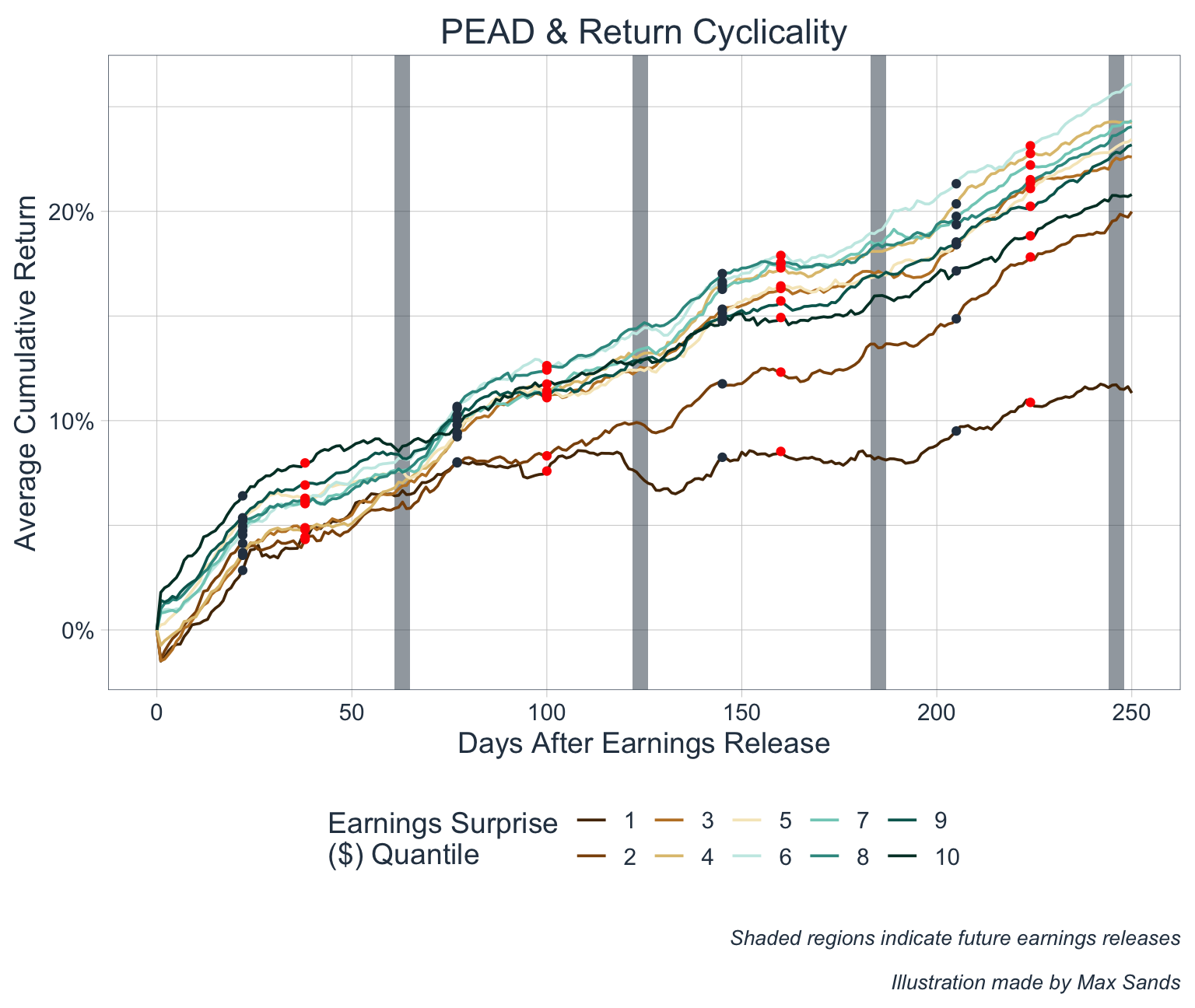

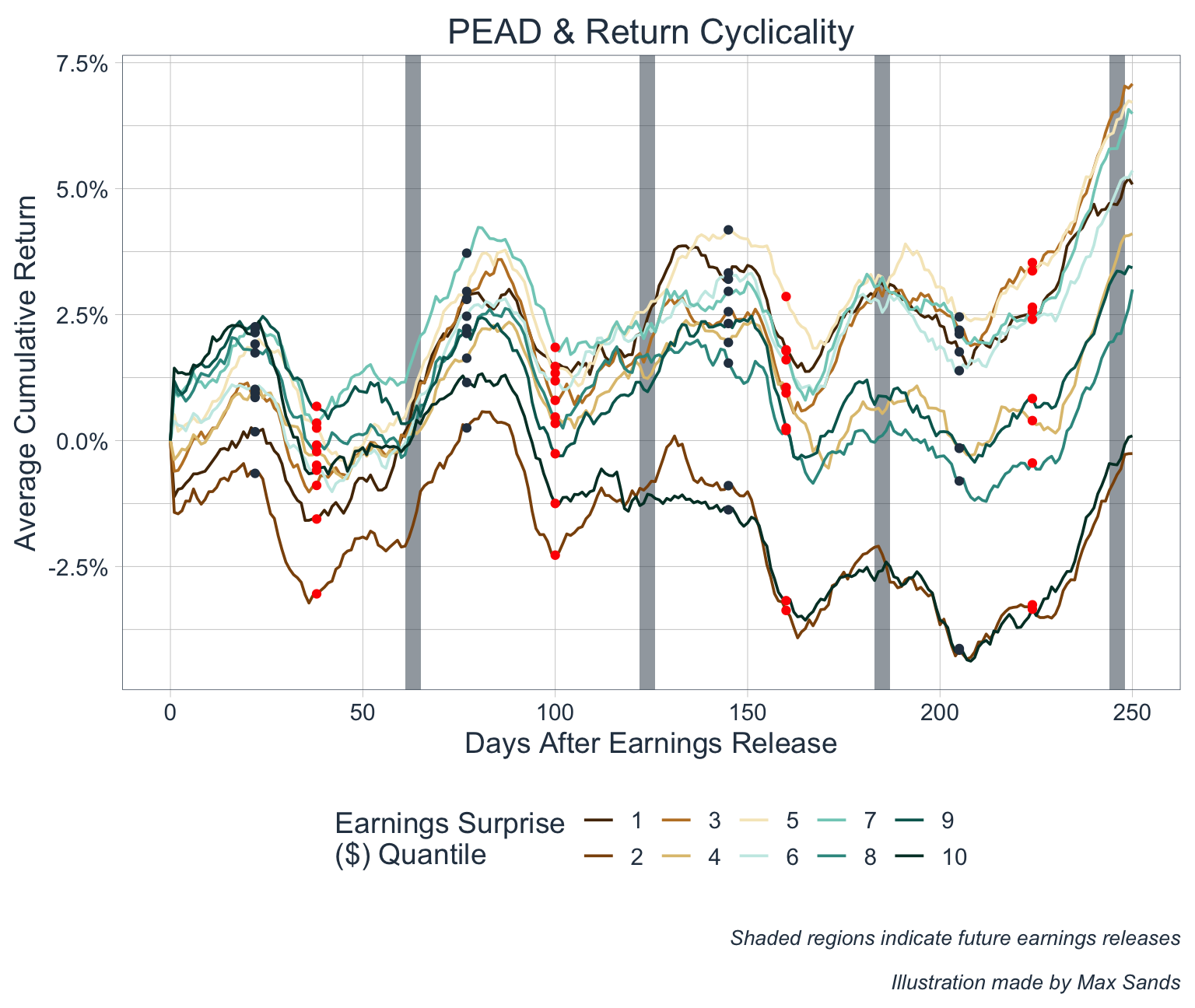

By focusing our starting period at the day after an earnings release, we clearly see that almost all of the alpha is generated during after-hours. It is also clear that PEAD exists; on average, stocks continue to rise (in excess of what would be expected given current market conditions) when they beat on earnings, or they continue to fall when they under-perform on earnings. However, as we can see from the plot, the marginal benefit of entering a position the morning after an earnings release for 20 trading days ranges from approximately 0% to 0.5%.

Because this marginal benefit is relatively small, and there is likely a lot of variation around these averages, it is unlikely that building a PEAD trading strategy would be significantly profitable relative to a simple long position in the SP500, especially when considering frictional trading costs.

Taking a Step Back

Logically, there are 4 ways to capitalize on PEAD:

- To build a trading strategy that predicts returns for a target company prior to an earnings release:

- Clearly, this strategy, if done correctly, can generate superior returns as most of the alpha occurs after-hours.

- This strategy would likely require company-specific models and in-depth knowledge of companies and industry dynamics.

- Clearly, this strategy, if done correctly, can generate superior returns as most of the alpha occurs after-hours.

- To build a trading strategy that predicts returns for a target company after an earnings release:

- The above analysis demonstrates that this is possible, but it is likely very difficult and may not generate significantly superior returns (at least for U.S. Large-Cap companies).

- To build a trading strategy that predicts returns of a peer/competitor company prior to an earnings release from the target company:

- Again this is likely to generate superior returns and will likely require company-specific models and in-depth knowledge of companies and industry dynamics.

- To build a trading strategy that predicts returns of a peer/competitor company after an earnings release from the target company.

- While this strategy will likely not produce results superior to those that enter positions prior to earnings releases, it may produce more significant results when compared to option (2).

Since our above analysis nullifies option (2), and options (1) & (3) require company specific models, let’s investigate option (4): how do peer/competitors perform after a target company releases earnings?

To be clear, if done correctly, options (1) & (3) are likely the most profitable, as demonstrated by the following table:

| Average | MAD | Count | |

|---|---|---|---|

| NFLX | −0.75% | 9.54% | 33 |

| ALGN | 1.23% | 8.83% | 33 |

| ANET | 0.66% | 8.06% | 33 |

| FTNT | 0.09% | 7.66% | 33 |

| EXPE | −0.62% | 7.54% | 33 |

| PODD | 2.71% | 7.23% | 33 |

| META | −0.29% | 7.21% | 33 |

| DXCM | 2.79% | 7.16% | 33 |

| AKAM | −1.98% | 7.06% | 33 |

| PAYC | 1.79% | 6.96% | 33 |

| Average Top 10 | 0.56% | 7.72% | 33 |

| Average All SP500 Companies | 0.14% | 2.54% | 27 |

The MAD column indicates average absolute distance from the average. In other words, of the 33 observations of earnings announcements in our data set, NFLX averaged a return of -0.75% the day after an earnings release, but the average distance of each return from -0.75% was 9.54%. Clearly, making a few correct bets regarding NFLX’s stock price movements around earnings release dates would have been very profitable in a short period of time.

Peer Company Analysis

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Rhoncus est pellentesque elit ullamcorper dignissim cras tincidunt lobortis. Cursus sit amet dictum sit amet justo donec enim. Amet nulla facilisi morbi tempus iaculis urna id. Mauris a diam maecenas sed enim. Dolor magna eget est lorem. Odio aenean sed adipiscing diam donec adipiscing. Massa eget egestas purus viverra accumsan in nisl. Facilisi morbi tempus iaculis urna. Pellentesque habitant morbi tristique senectus et. Odio ut sem nulla pharetra. Placerat in egestas erat imperdiet sed euismod nisi. Sed vulputate odio ut enim blandit volutpat maecenas. Ultrices gravida dictum fusce ut. Semper auctor neque vitae tempus quam pellentesque nec nam.

Leo in vitae turpis massa sed. Molestie ac feugiat sed lectus vestibulum. Egestas egestas fringilla phasellus faucibus. Quam id leo in vitae. Ipsum consequat nisl vel pretium lectus quam id. Imperdiet proin fermentum leo vel orci porta non pulvinar. Purus viverra accumsan in nisl nisi scelerisque eu ultrices. Magna fermentum iaculis eu non. Ipsum dolor sit amet consectetur adipiscing elit. Cursus sit amet dictum sit amet justo donec. Pellentesque elit eget gravida cum sociis. Nam libero justo laoreet sit amet cursus sit amet. Vestibulum morbi blandit cursus risus at ultrices mi tempus. Euismod in pellentesque massa placerat duis ultricies lacus sed. Ornare aenean euismod elementum nisi quis. Viverra orci sagittis eu volutpat odio facilisis mauris. Turpis in eu mi bibendum neque. Ut consequat semper viverra nam libero.

Morbi tristique senectus et netus et malesuada fames ac turpis. Nulla aliquet enim tortor at auctor urna nunc id. Volutpat ac tincidunt vitae semper quis. Risus at ultrices mi tempus imperdiet. Facilisis magna etiam tempor orci eu lobortis elementum. Sagittis eu volutpat odio facilisis mauris sit amet massa. Elementum curabitur vitae nunc sed. Feugiat nibh sed pulvinar proin. Consectetur lorem donec massa sapien faucibus et molestie ac. Nulla pellentesque dignissim enim sit amet venenatis urna cursus. Tristique risus nec feugiat in fermentum posuere urna nec. At in tellus integer feugiat. Enim nec dui nunc mattis enim.

Tellus in hac habitasse platea. Aenean et tortor at risus viverra adipiscing. Phasellus vestibulum lorem sed risus ultricies. Cursus eget nunc scelerisque viverra mauris in. Ultrices eros in cursus turpis massa tincidunt dui. Vitae suscipit tellus mauris a diam maecenas sed enim ut. Volutpat ac tincidunt vitae semper quis. Mi in nulla posuere sollicitudin aliquam ultrices sagittis orci. Est ultricies integer quis auctor elit sed. Massa vitae tortor condimentum lacinia quis vel eros. Sed odio morbi quis commodo odio aenean sed adipiscing. Euismod quis viverra nibh cras pulvinar mattis nunc sed. Cursus mattis molestie a iaculis at erat pellentesque adipiscing commodo.

Ac felis donec et odio pellentesque diam. Nisl nisi scelerisque eu ultrices vitae auctor eu augue. Volutpat maecenas volutpat blandit aliquam etiam. At lectus urna duis convallis convallis. Donec et odio pellentesque diam volutpat commodo. Consectetur adipiscing elit pellentesque habitant morbi tristique senectus et netus. Amet volutpat consequat mauris nunc. Blandit massa enim nec dui nunc mattis enim. In pellentesque massa placerat duis ultricies. Massa tincidunt nunc pulvinar sapien et ligula ullamcorper malesuada. Sed id semper risus in hendrerit. Arcu dui vivamus arcu felis bibendum ut tristique et. Id venenatis a condimentum vitae sapien. Diam quis enim lobortis scelerisque. Adipiscing elit ut aliquam purus sit amet. Euismod elementum nisi quis eleifend quam adipiscing vitae proin. Nec tincidunt praesent semper feugiat nibh sed pulvinar proin gravida.

Aliquet eget sit amet tellus cras adipiscing enim eu. Egestas pretium aenean pharetra magna ac placerat vestibulum. Vel risus commodo viverra maecenas accumsan lacus vel. Platea dictumst quisque sagittis purus sit amet. Sit amet aliquam id diam maecenas ultricies mi. Tellus elementum sagittis vitae et leo duis ut diam quam. Vitae congue eu consequat ac felis. Cursus in hac habitasse platea dictumst quisque sagittis purus sit. Vitae ultricies leo integer malesuada. Aliquet nibh praesent tristique magna sit amet purus. Neque volutpat ac tincidunt vitae semper. Egestas erat imperdiet sed euismod nisi porta.

Non quam lacus suspendisse faucibus interdum posuere lorem ipsum dolor. Augue lacus viverra vitae congue eu consequat ac. Sodales ut eu sem integer vitae justo. Integer enim neque volutpat ac tincidunt. Non odio euismod lacinia at quis risus sed vulputate. Elementum nisi quis eleifend quam adipiscing vitae proin sagittis. Pellentesque sit amet porttitor eget dolor morbi non arcu. Cras ornare arcu dui vivamus arcu. Ut pharetra sit amet aliquam id diam maecenas. Nulla pharetra diam sit amet nisl suscipit adipiscing bibendum. Mi bibendum neque egestas congue quisque egestas diam.

Adipiscing tristique risus nec feugiat in fermentum posuere. Nunc id cursus metus aliquam eleifend mi in nulla. Vulputate enim nulla aliquet porttitor lacus. Fringilla est ullamcorper eget nulla facilisi etiam dignissim diam quis. Habitant morbi tristique senectus et netus et malesuada. Volutpat diam ut venenatis tellus in. Quisque id diam vel quam elementum pulvinar etiam non. Posuere urna nec tincidunt praesent. Accumsan lacus vel facilisis volutpat est velit egestas dui id. Pretium nibh ipsum consequat nisl vel pretium.

Et tortor at risus viverra adipiscing at in. Integer malesuada nunc vel risus commodo viverra maecenas accumsan. Enim praesent elementum facilisis leo vel. Eget lorem dolor sed viverra ipsum nunc aliquet bibendum. Quam nulla porttitor massa id neque aliquam vestibulum morbi. Vestibulum lorem sed risus ultricies tristique. Nibh praesent tristique magna sit. Congue mauris rhoncus aenean vel elit scelerisque mauris pellentesque pulvinar. Laoreet id donec ultrices tincidunt arcu. Venenatis cras sed felis eget velit aliquet sagittis id. Lacinia quis vel eros donec. Pellentesque pulvinar pellentesque habitant morbi tristique senectus et. Lectus magna fringilla urna porttitor rhoncus dolor purus non enim.

Gravida rutrum quisque non tellus orci ac auctor augue. Amet massa vitae tortor condimentum lacinia. Tincidunt lobortis feugiat vivamus at augue eget arcu. Egestas erat imperdiet sed euismod nisi porta lorem mollis. Et netus et malesuada fames. Adipiscing tristique risus nec feugiat in fermentum posuere urna nec. Non enim praesent elementum facilisis. Velit egestas dui id ornare arcu odio ut. Scelerisque varius morbi enim nunc faucibus a pellentesque. Morbi quis commodo odio aenean. Sem integer vitae justo eget magna fermentum iaculis eu non. Tincidunt nunc pulvinar sapien et ligula ullamcorper malesuada. Neque aliquam vestibulum morbi blandit cursus risus at ultrices mi. Est ullamcorper eget nulla facilisi etiam dignissim. Platea dictumst quisque sagittis purus sit amet. Morbi tempus iaculis urna id volutpat lacus laoreet. Ut venenatis tellus in metus vulputate eu scelerisque felis. Vulputate mi sit amet mauris commodo quis imperdiet. Commodo elit at imperdiet dui. Ac auctor augue mauris augue neque gravida in fermentum et.

Aliquam etiam erat velit scelerisque in. Malesuada nunc vel risus commodo viverra maecenas accumsan lacus. Lorem dolor sed viverra ipsum nunc aliquet bibendum enim facilisis. Ornare quam viverra orci sagittis. Quam elementum pulvinar etiam non. Semper quis lectus nulla at. Feugiat in ante metus dictum at tempor. Integer vitae justo eget magna fermentum iaculis eu non diam. Diam in arcu cursus euismod quis viverra nibh cras. Elementum tempus egestas sed sed risus pretium quam vulputate. Volutpat diam ut venenatis tellus in metus vulputate eu. Sapien nec sagittis aliquam malesuada bibendum. Faucibus purus in massa tempor. Nisi porta lorem mollis aliquam.

Rhoncus dolor purus non enim praesent elementum facilisis leo. Venenatis lectus magna fringilla urna porttitor rhoncus dolor. Turpis nunc eget lorem dolor sed viverra ipsum nunc. Volutpat lacus laoreet non curabitur. Donec adipiscing tristique risus nec feugiat in. Non odio euismod lacinia at quis risus sed vulputate. Vitae turpis massa sed elementum tempus egestas. Bibendum neque egestas congue quisque egestas diam in arcu. Nunc id cursus metus aliquam eleifend mi in nulla. A condimentum vitae sapien pellentesque habitant morbi. Lacus suspendisse faucibus interdum posuere lorem ipsum. Sed libero enim sed faucibus turpis in eu. Mauris vitae ultricies leo integer malesuada nunc vel. Pulvinar etiam non quam lacus suspendisse faucibus. Et malesuada fames ac turpis egestas integer eget. Faucibus ornare suspendisse sed nisi. Ultrices gravida dictum fusce ut placerat orci. Elementum nisi quis eleifend quam.

Ultricies lacus sed turpis tincidunt id. Urna nunc id cursus metus aliquam eleifend mi. Ullamcorper sit amet risus nullam eget felis eget nunc lobortis. Egestas dui id ornare arcu odio ut sem nulla. Viverra suspendisse potenti nullam ac tortor vitae purus. A erat nam at lectus urna duis convallis convallis. Ac turpis egestas integer eget aliquet. Neque ornare aenean euismod elementum nisi. Tortor vitae purus faucibus ornare suspendisse sed nisi. Morbi tristique senectus et netus et malesuada fames. Mattis rhoncus urna neque viverra justo nec. Diam in arcu cursus euismod quis viverra nibh cras pulvinar. Non pulvinar neque laoreet suspendisse. Montes nascetur ridiculus mus mauris. Orci a scelerisque purus semper eget duis at tellus at. Dui nunc mattis enim ut tellus elementum sagittis. Id volutpat lacus laoreet non curabitur gravida.

Dui ut ornare lectus sit. Suspendisse in est ante in nibh mauris cursus mattis molestie. Cras pulvinar mattis nunc sed blandit libero volutpat sed. Semper viverra nam libero justo laoreet. Id consectetur purus ut faucibus. Cursus turpis massa tincidunt dui. Et malesuada fames ac turpis egestas maecenas pharetra convallis posuere. Ipsum dolor sit amet consectetur. Et netus et malesuada fames ac turpis egestas. In fermentum et sollicitudin ac orci phasellus egestas. Vel elit scelerisque mauris pellentesque pulvinar pellentesque habitant. Lectus nulla at volutpat diam ut venenatis tellus. Vivamus at augue eget arcu dictum.

Nulla pellentesque dignissim enim sit amet venenatis urna cursus. Sit amet mauris commodo quis. In tellus integer feugiat scelerisque varius morbi enim nunc faucibus. Vulputate ut pharetra sit amet. Risus quis varius quam quisque id diam vel quam. Ipsum faucibus vitae aliquet nec ullamcorper sit. Feugiat in ante metus dictum. Laoreet non curabitur gravida arcu ac. Ipsum suspendisse ultrices gravida dictum. Ultrices mi tempus imperdiet nulla malesuada pellentesque elit. Tristique senectus et netus et malesuada fames ac. Sed felis eget velit aliquet sagittis. Vitae congue mauris rhoncus aenean vel elit. At lectus urna duis convallis convallis tellus id interdum. Neque aliquam vestibulum morbi blandit. Nunc id cursus metus aliquam eleifend mi. Vel quam elementum pulvinar etiam non. Phasellus egestas tellus rutrum tellus pellentesque eu. Eget duis at tellus at urna condimentum mattis pellentesque. Lacus vel facilisis volutpat est velit egestas dui.

Gravida arcu ac tortor dignissim convallis aenean et tortor at. Egestas dui id ornare arcu odio ut. Viverra nibh cras pulvinar mattis nunc. Odio aenean sed adipiscing diam donec adipiscing tristique risus nec. Euismod lacinia at quis risus sed vulputate odio. Eu consequat ac felis donec et odio pellentesque diam volutpat. Consequat nisl vel pretium lectus. Tempus imperdiet nulla malesuada pellentesque elit eget gravida cum sociis. Habitant morbi tristique senectus et netus et malesuada. Purus faucibus ornare suspendisse sed. Libero id faucibus nisl tincidunt eget nullam. Eget duis at tellus at urna condimentum mattis. Faucibus vitae aliquet nec ullamcorper sit amet. Gravida rutrum quisque non tellus orci ac auctor augue mauris. Facilisis leo vel fringilla est ullamcorper eget nulla facilisi etiam. Et tortor consequat id porta nibh venenatis cras sed.

At volutpat diam ut venenatis. Nisi vitae suscipit tellus mauris. Tellus rutrum tellus pellentesque eu tincidunt tortor aliquam. Odio facilisis mauris sit amet massa vitae tortor condimentum lacinia. Ipsum a arcu cursus vitae. Dis parturient montes nascetur ridiculus mus. Semper eget duis at tellus at urna condimentum mattis pellentesque. Quisque sagittis purus sit amet volutpat consequat mauris nunc congue. Mauris sit amet massa vitae tortor condimentum. Tortor id aliquet lectus proin nibh. Auctor elit sed vulputate mi sit amet mauris commodo quis. Risus in hendrerit gravida rutrum. Et netus et malesuada fames ac turpis egestas. Non quam lacus suspendisse faucibus interdum posuere lorem ipsum dolor. Non tellus orci ac auctor augue mauris.

Varius morbi enim nunc faucibus a pellentesque sit. Sem integer vitae justo eget magna fermentum iaculis eu. Tortor at risus viverra adipiscing at. Scelerisque eu ultrices vitae auctor eu augue ut. Volutpat commodo sed egestas egestas fringilla phasellus faucibus. Neque ornare aenean euismod elementum nisi quis eleifend quam. Augue neque gravida in fermentum. Nunc mattis enim ut tellus elementum. Aliquam purus sit amet luctus venenatis lectus. Amet purus gravida quis blandit.

Elementum sagittis vitae et leo. Molestie ac feugiat sed lectus vestibulum mattis ullamcorper velit. Massa enim nec dui nunc mattis. Proin sed libero enim sed faucibus turpis. Elementum facilisis leo vel fringilla est ullamcorper eget. Nibh sed pulvinar proin gravida hendrerit lectus a. Ultricies integer quis auctor elit sed vulputate mi. Et netus et malesuada fames ac turpis egestas. Quisque egestas diam in arcu cursus euismod. Commodo odio aenean sed adipiscing diam donec adipiscing.

Non pulvinar neque laoreet suspendisse interdum consectetur libero. Eget egestas purus viverra accumsan in nisl. Sodales ut etiam sit amet nisl purus in mollis. Tempus imperdiet nulla malesuada pellentesque elit eget gravida cum. Lectus sit amet est placerat in egestas erat. Feugiat in ante metus dictum at tempor commodo ullamcorper a. Enim praesent elementum facilisis leo. Ipsum nunc aliquet bibendum enim. Lacus suspendisse faucibus interdum posuere. Varius sit amet mattis vulputate enim nulla aliquet porttitor lacus. Consequat mauris nunc congue nisi. Ultrices neque ornare aenean euismod elementum nisi quis. Velit euismod in pellentesque massa placerat duis ultricies. In est ante in nibh mauris cursus mattis molestie a. Lacus luctus accumsan tortor posuere ac ut consequat semper viverra.

Final Remarks

The above is intended as an exploration of historical data, and all statements and opinions are expressly my own; neither should be construed as investment advice.